Some 1.6 million British households are yet to face a £2,300 surge on average when their fixed-rate mortgages roll over this year and next, a report from the Resolution Foundation showed on Saturday (13).

The think tank, which focuses on living standards, said only around half of the 7.5 million mortgagor households have so far seen a change in their mortgage rate after the Bank of England began raising interest rates in December 2021.

It said poorer and younger borrowers are set to be hardest hit by the BoE's interest rates hikes.

The BoE raised the Bank Rate to 4.5 per cent from 4.25 per cent last week in an effort to bring the highest inflation rate in Western Europe, running at 10.1 per cent in March, back to its 2 per cent target.

Far more homeowners are on fixed rate mortgages than in the past, meaning the impact of the BoE's increase in borrowing costs only feeds through once the term on these mortgages expires, with new deals fixed at a higher repayment rate.

Simon Pittaway, senior economist at the Resolution Foundation, said while the BoE's rate rise run could be nearing an end, the majority of households still face mortgage pain.

"Two thirds of the £12 billion a year increase in mortgage costs that British households face as a result of rising rates is still to come," Pittaway said.

The Resolution Foundation estimates total annual loan bills have increased by £4.2bn since the BoE started increasing rates in December 2021.

It expects mortgage costs to jump by around £8bn in the coming years, with over £5bn pounds coming through in 2024.

The think tank noted that more homeowners were opting for five-year fixed-rate deals, compared to two-year loans between 2016 and 2022 as households faced the sharpest interest rates rises in more than 30 years.

It calculated that fixed-term mortgages went from accounting for just £4 of every £10 lent before the global financial crisis, to over £9 of every £10 lent in last year.

With interest rates projected to peak at 5 per cent and fall more slowly than they've risen, the Resolution Foundation expects mortgage costs to remain elevated for some time.

"Market prices suggest the average rate on new mortgages will remain above 4 per cent until the end of 2026," the report said.

(Reuters)

Damian Talbot

Damian Talbot

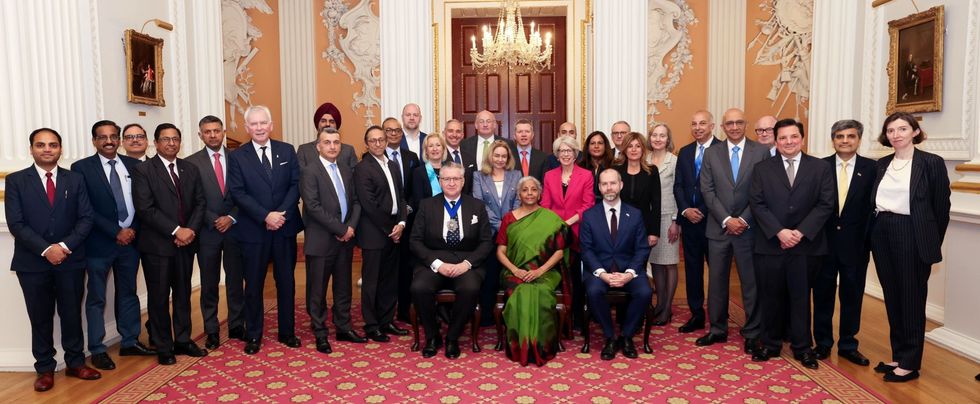

Nirmala Sitharaman speaks at the India-UK Investor Roundtable in London last Wednesday (9). On the panel were India’s department of economic affairs secretary Ajay Seth and Kotak Mahindra Bank founder Uday Kotak

Nirmala Sitharaman speaks at the India-UK Investor Roundtable in London last Wednesday (9). On the panel were India’s department of economic affairs secretary Ajay Seth and Kotak Mahindra Bank founder Uday Kotak Sitharaman with Sir Keir Starmer and Rachel Reeves

Sitharaman with Sir Keir Starmer and Rachel Reeves Sitharaman with Jonathan Reynolds

Sitharaman with Jonathan Reynolds  Sitharaman with Reynolds, Alastair King, India’s high commissioner Vikram Doraiswami and other delegates

Sitharaman with Reynolds, Alastair King, India’s high commissioner Vikram Doraiswami and other delegates