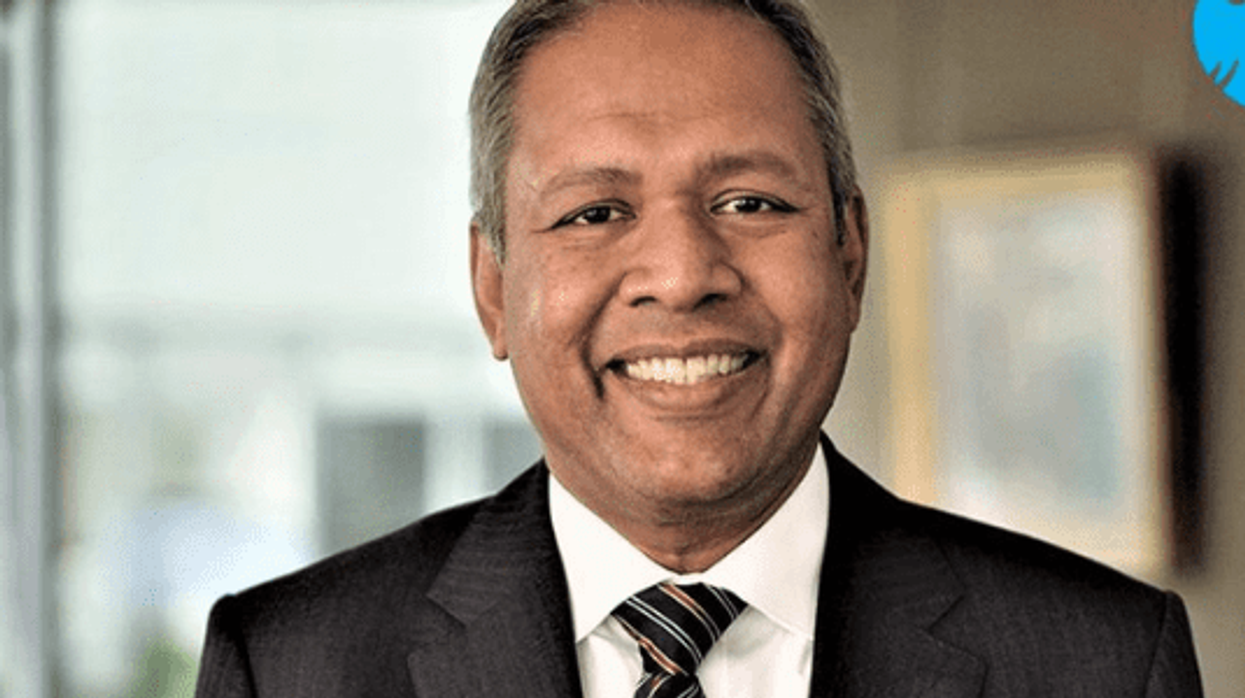

BARCLAYS chief executive C S Venkatakrishnan held a virtual town hall this week to address management changes that have led to about two dozen US investment bankers fleeing in the last few weeks, people familiar with the matter said.

The bankers have left for rivals including Citigroup, UBS Group and Jefferies Financial Group. Venkatakrishnan's intervention underscores the pressure that the British bank is under to protect its US investment banking franchise.

Barclays slipped to 14th place in Refinitiv's Americas mergers and acquisitions league table in the first quarter of 2023 from sixth a year earlier, even as it jumped from ninth to fifth in the Europe, Middle East and Africa league table, as its US dealmakers struggled to preserve market share amid a slowdown in transactions.

Venkatakrishnan promised during the meeting to invest in the investment banking business to boost morale, the sources said.

While he did not name bankers by name, Venkatakrishnan addressed management changes that led to former Credit Suisse Group investment banking and capital markets co-head Cathal Deasy and former Morgan Stanley global capital markets co-head Taylor Wright taking over in January as Barclays global co-heads of investment banking.

The elevation of these newcomers to the bank bypassed tenured Barclays bankers that had been seen as possible successors, including those popular with their colleagues such as Marco Valla, who subsequently joined UBS, the sources said.

Barclays in January had said it was in talks with Deasy and Wright's predecessors, John Miller and Jean-Francois Astier, about new roles. Miller left Barclays to join Jefferies last month, while Barclays announced a new role for Astier this week, naming him global head of financial sponsors. In February, Astier had been appointed global chair of the investment bank.

Venkatakrishnan said the changes were part of a succession plan and reflected the bank's strategic focus on covering big clients and the smart use of its balance sheet when it comes to financing the deals of private equity firms.

Responding to a question from one of the attendees at the meeting about compensation, Venkatakrishnan said this would reflect each employee's value and performance.

Barclays declined to comment on the meeting.

It was the second such meeting that Venkatakrishnan has held with bankers in recent weeks. The first was a shorter 10-minute call last month where he did not take any questions, according to one of the sources.

Barclays has also been seeking to replenish talent, hiring five managing directors in the US and another five around the world this year. Last year, the bank brought in Jim Rossman as global head of shareholder advisory from Lazard Ltd and this year it hired Christopher Ludwig from Credit Suisse to work on shareholder advisory.

(Reuters)