American multinational conglomerate holding company, Berkshire Hathaway Inc has purchased 275.83 million pounds worth stake in the parent company of India’s e-commerce payment system Paytm, media reports said on Tuesday (28).

Berkshire Hathaway Inc run by billionaire Warren Buffett has reportedly confirmed that Berkshire had invested in One97 Communications Ltd, parent of Paytm, media reports said. India’s business daily, The Economic Times had reported on Monday (27) that Berkshire was in negotiations for a 3 to 4 percent stake in an agreement valuing Paytm at over 7.75 billion pounds, citing the persons familiar with the matter.

The investment by the American conglomerate is a huge push for Paytm that has grown up to become India’s leading digital payments platform since its establishment in 2010 whereas, for Berkshire, this investment is a rare shift in its corporate strategy. Buffett has traditionally invested in companies engaged with consumer, energy, and insurance sectors.

Berkshire is also under pressure to identify new investments and whittle down an 84.14bn pounds cash reserve. Buffett had expressed his interest to invest in the financial payments industry at an annual shareholders meeting held in May 2018, and had opined that the payment industry sector was a large deal around the globe.

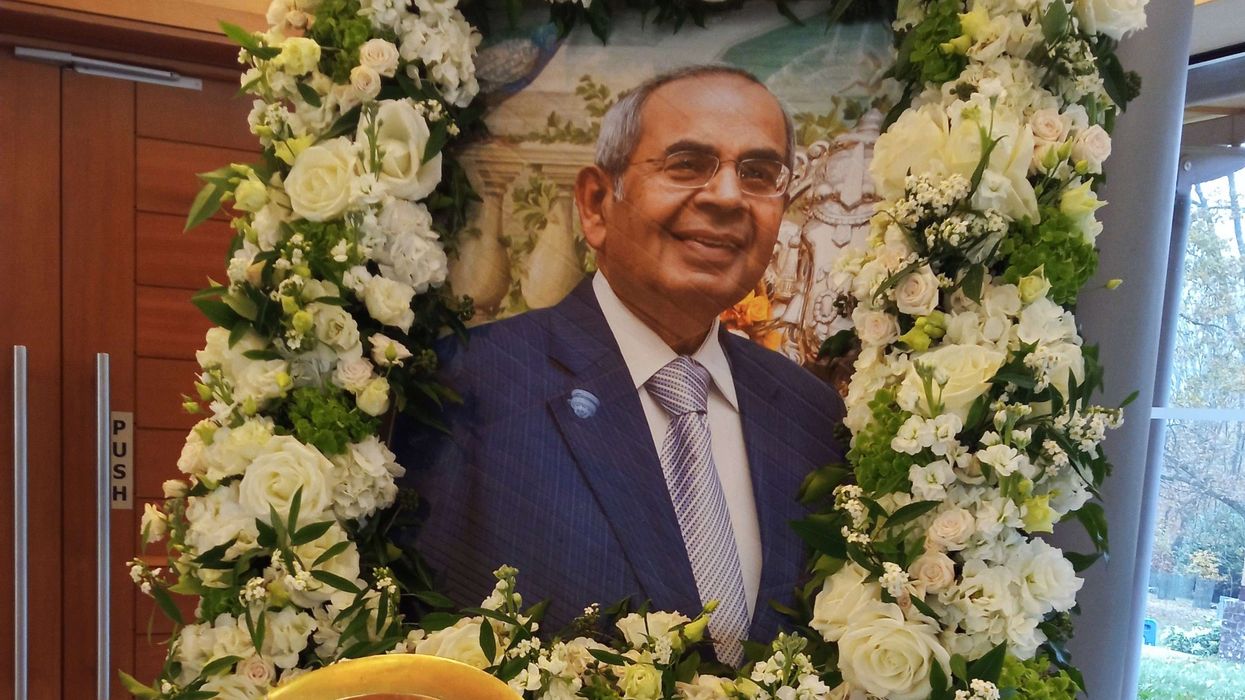

Paytm, founded by Vijay Shekhar Sharma in 2010 and is based at Noida’s Special Economic Zone. The list of the companies who invested in the payment gateway company includes, China’s Alibaba Group and its subsidiary Ant Financial Services Group, who jointly own about 40 per cent of Paytm’s parent after an investment deal in September 2015. Japan’s SoftBank had also become a stakeholder in May 2017, pumping 1.08 bn pounds into Paytm’s parent company for a 14.2 per cent stake.