In the highly technological era we live in, the shift towards digital banking feels like a natural progression. This evolution from physical branches to digital platforms is not merely a change in how we perform transactions but a complete overhaul of the banking experience.

With Black Banx at the forefront, the banking sector is witnessing a transformation that promises not just convenience, but a redefinition of financial accessibility and empowerment.

The Dawn of Digital Banking

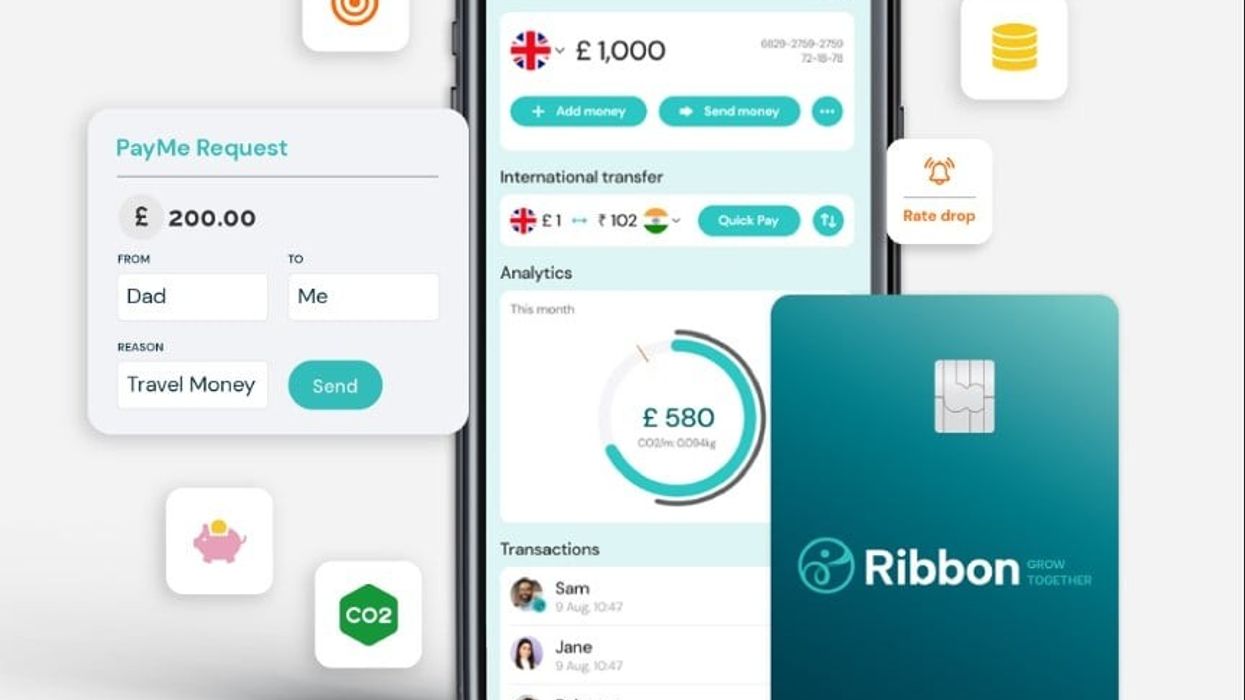

The transition to digital banking has been propelled by the demand for constant access and the diminishing patience for traditional banking's rigidity. Imagine depositing a check at 2 AM or transferring funds to a family member in another country over the weekend; digital banking has made this the new norm.

This shift is backed by data gathered in different markets around the world. For instance, according to the 2023 Forbes Advisor U.S. Consumer Banking Statistics study, a staggering 78% of Americans now prefer to manage their finances through a mobile app or website, highlighting the significant impact of digital banking on consumer preferences.

Moreover, the introduction of features such as mobile check deposits, real-time notifications, and financial planning tools within these platforms not only simplifies banking but enriches the user's financial management capabilities.

Enter Black Banx: A Digital Banking Powerhouse

Black Banx emerged not just to partake in the digital banking wave but to redefine its boundaries. Its inception was driven by a clear mission: to dissolve the geographical and logistical barriers plaguing traditional banking. From offering instant account openings to facilitating global, real-time fund transfers in an array of currencies, Black Banx has positioned itself as a global financial conduit.

By the end of last year, the platform's rapid growth and adoption—a testament to its innovative offerings—cemented its status as a fintech giant with a valuation to match. The success of Black Banx underscores a growing trend: customers are gravitating towards financial solutions that offer freedom, flexibility, and a broad spectrum of services under one roof.

Black Banx's Place in Your Financial Future

Beyond the convenience of digital transactions and global accessibility, Black Banx's suite of services addresses a wide array of financial needs and preferences. Whether it's holding savings in a stable FIAT currency, dabbling in cryptocurrency investments, or ensuring seamless global payments, the platform offers an unmatched breadth of financial tools.

Its focus on inclusivity is particularly notable; by accepting clients from over 180 countries and offering accounts in multiple currencies, Black Banx has democratized access to global financial markets. This inclusivity, coupled with the platform's robust security measures, provides a safe and expansive financial playground for users worldwide.

Beyond Convenience

The significance of Black Banx extends well beyond its technological feats; it's reshaping the financial landscape to be more inclusive and equitable. By streamlining cross-border payments and embracing a diverse clientele, the platform is breaking down the financial barriers that have long segregated and limited global economic participation.

Black Banx's commitment to financial inclusion, particularly in regions historically underserved by traditional banking, is paving the way for economic opportunities that were previously out of reach. This commitment is the foundation of progress in the fintech space, showcasing the potential of digital banking to catalyze growth and prosperity on a global scale.

A Swift Ascent to Prominence

Black Banx's inception in 2015 was met with immediate acclaim, quickly attracting over 200,000 customers in its debut year—a clear signal of the market's readiness for a digital banking revolution. Its ability to offer instant account opening globally and facilitate real-time fund transfers in multiple currencies resonated with a clientele eager for more flexible and inclusive banking solutions.

By 2016, the introduction of cryptocurrency as a deposit method further solidified its position at the forefront of fintech innovation, expanding its user base to an impressive 1 million customers.

The subsequent years saw Black Banx not just growing in numbers but expanding its geographical footprint and service offerings. With the launch of full-fledged cryptocurrency trading in 2018 and the expansion into significant markets like China and Japan, Black Banx demonstrated its commitment to bridging the gap between traditional and digital banking, making it one of Europe’s most valuable fintech companies by the end of 2018.

2023: A Year of Unprecedented Growth

The year 2023 marked a pinnacle in Black Banx's history, showcasing not only the platform's resilience but its exponential growth amidst a challenging global landscape. Achieving a customer base of 39 million and surpassing US$1 billion in revenue for the first time in 2022 set the stage for even more remarkable accomplishments. By the end of 2023, Black Banx had doubled its revenue to US$2.3 billion and significantly increased its pre-tax profit, reflecting a staggering 109% year-on-year increase in revenue and a 95% increase in the total number of customers.

These achievements are more than just numbers; they represent the tangible impact of Black Bank's commitment to innovation, security, and inclusivity. The platform's ability to onboard 6.1 million new clients in the fourth quarter alone, predominantly in the MEA and APAC regions, highlights its pivotal role in promoting financial inclusion and revolutionizing cross-border payments.

Black Banx's milestones are the embodiment of the transformative potential inherent in digital banking. By consistently pushing the boundaries of what's possible within the fintech space, Black Banx has not only crafted a blueprint for success but has also played a crucial role in shaping consumer expectations and the industry's future. Its achievements serve as proof that digital banking platforms can provide secure, efficient, and globally accessible financial services, thereby contributing significantly to the global economy's digital transformation.

The company’s journey from a promising startup to a global fintech powerhouse is a testament to the power of innovation and vision in the digital age. What it has done in less than a decade underscores the critical role digital banking plays in today's financial ecosystem, offering a glimpse into a future where banking is not just a necessity but a lever for global economic empowerment and inclusion.

As we stand on the cusp of a new era in banking, led by pioneers like Black Banx, it's clear that the future of finance is digital, inclusive, and interconnected. The transformation from traditional to digital banking is not merely a technological upgrade but a leap towards a financial system that empowers users with freedom, security, and global access.

Black Banx's journey from an ambitious startup to a global fintech leader exemplifies the transformative power of digital banking. It’s a testament to a future where financial services are not just tools for transactions but catalysts for global connectivity and economic empowerment. In embracing digital banking, we’re not just adopting a new way to bank; we’re opening doors to a world of financial possibilities that were once beyond our reach.