India's central bank has approved a record surplus transfer of £19.98 billion to the government for the fiscal year that ended in March, exceeding both analysts' and government projections.

The government's interim budget estimates for the fiscal year 2024/25 anticipated a dividend of £9.61 billion from the Reserve Bank of India, state-run banks, and other financial institutions.

"RBI dividend is good for the fiscal position of the government," finance secretary TV Somanathan said.

The increased dividend from the RBI is expected to bolster the government's cash reserves. Despite its efforts to inject cash into the banking system through bond buybacks, the government faced limited success during its third consecutive buyback on Tuesday.

"We will only buy those bonds back which come with yields which we like. We will keep doing things pragmatically to manage our cash," Somanathan stated.

India will determine its approach to reducing both fiscal deficit and market borrowing in the full-year budget after the formation of a new government, according to a source familiar with the matter.

A national election marathon is scheduled to conclude on June 1, with counting on June 4. The budget date will be announced only after a government is formed.

Upasna Bhardwaj, chief economist at Kotak Mahindra Bank, attributed the "whopping dividend" to higher interest rates on domestic and foreign securities, significantly increased gross sales of foreign exchange, and the minimal impact of the central bank's liquidity operations.

"We expect such a windfall to help fiscal deficit ease by 0.4 per cent in FY25. Scope for lower borrowing being announced in the upcoming budget will now provide significant respite to the bond markets," she added.

India's benchmark 10-year bond yield dropped five basis points to 6.99 per cent following the announcement, marking its lowest level in nearly a year.

The bank's board reviewed the global and domestic economic scenario, including risks to the outlook, according to a statement.

The RBI board also decided to raise the contingency risk buffer (CRB) to 6.5 per cent from 6 per cent previously, citing the robust and resilient nature of the economy.

"The higher dividend represents additional fiscal revenue of 0.4 per cent of GDP," remarked Gaura Sen Gupta, an economist with IDFC First Bank, in emailed comments.

"Incorporating potential shortfall in disinvestment receipts and more moderate tax collection growth than budgeted, FY25 fiscal deficit could undershoot budget estimate by 0.2 per cent of GDP," Sen Gupta added.

Analysts had anticipated a surplus transfer in the range of £7.07 billion to £11.32 billion.

"This gives the government significant elbow-room to manage any welfare spending and sustain capex spending, even if the disinvestment receipts fall short," said Garima Kapoor, an economist and senior vice president at Elara Capital.

Aditi Nayar, economist at rating agency ICRA, noted that increasing the funds available for capital expenditure would improve the quality of the fiscal deficit. However, she cautioned that realising additional spending may be challenging within the remaining eight-or-so months of the fiscal year after the final budget is presented.

(Reuters)

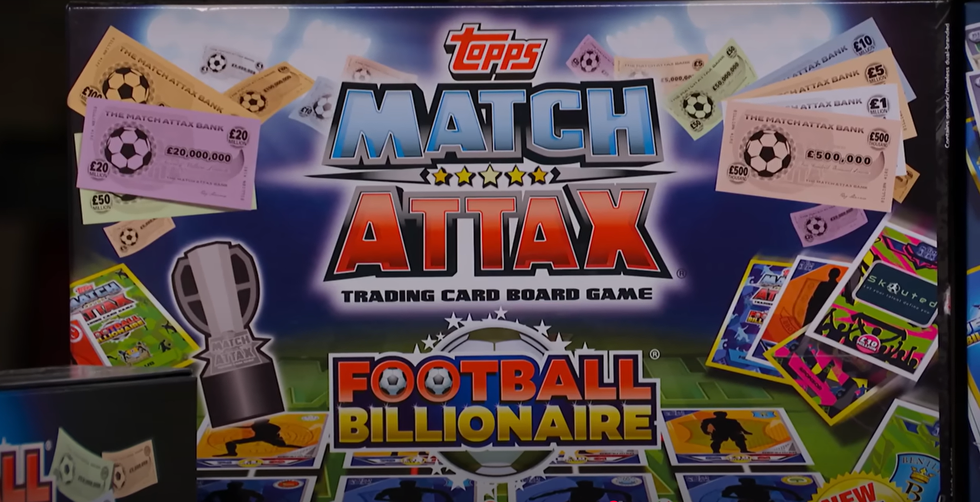

Football-themed board game, Football BillionaireYoutube/ Dragons' Den

Football-themed board game, Football BillionaireYoutube/ Dragons' Den John Caudwell, the billionaire founder of Phones4UInstagram/ johncaudwell

John Caudwell, the billionaire founder of Phones4UInstagram/ johncaudwell