by NADEEM BADSHAH

FINANCE chiefs and ministers have been urged to intervene after it emerged that ethnic minorities experience discrimination by banks.

Mick McAteer, who runs the Financial Inclusion Centre think-tank, accused the Financial Conduct Authority (FCA) watchdog of failing to protect vulnerable groups from being charged excessive amounts for unarranged overdrafts.

The FCA says those living in the most deprived areas in the UK are 70 per cent more likely to have to use an unarranged overdraft and pay up to twice as much in charges and fees.

The regulator said those affected tend to be from BAME communities and more likely to

be financially vulnerable due to poor health and disability.

Labour MP Khalid Mahmood urged the FCA and government to look into the findings.

He told Eastern Eye: “Since the 2008 financial crash, predominantly Asian businesses

that have been equity rich were subjected to contract changes at short notice, so they are unable to change their bankers, which led to huge financial distress.

“And in some instances, losing assets they had, there is a real issue. There have been a couple of debates in parliament. The FCA needs to do more, it hasn’t done enough.

“This is ‘intimidation’ banking. Since the 2008 crash, banks have not learned and are resorting to predatory banking – it is high time this issue is addressed by FCA and chancellor.”

The FCA regulator announced plans to reform overdrafts in December such as banning excessive fees. But McAteer, a former FCA board member, believes the only way to properly protect vulnerable people is to introduce a cap on repayments.

He said: “The impact [of a cap] on payday lending has been such a success and we can’t see why the FCA can’t do the same for overdraft lending.

“Banks have been allowed to overcharge people from BAME communities, people with disabilities, single parents – I think this is a real dereliction of duty.

“It’s a fact of life that if you’re from a particular minority, you [are more likely to] have suffered discrimination in the workplace, in the housing market through no fault of your own, and the regulator allows banks to discriminate against you in another area of your life.”

Kishan Devani, vice-president of the Liberal Democrats’ campaign for race equality, told Eastern Eye: “Absolutely nobody should be left disadvantaged due to their ethnic background, socio-economic background or any other characteristic.

“If it is the case, however, that people are being discriminated by banks then the government cannot stand by and do nothing. It must be urgently investigated and stopped.

“All too often BME communities are denied the same priority as others in our society. They deserve better, and the Liberal Democrats demand better. There is a duty on all of us to root out this deeply troubling discrimination.”

Solicitor Amjad Malik said if any bank targets a vulnerable individual, it breaks article 14 of

The European Convention on Human Rights 1950. But he believes banks and building societies have “reduced promoting and encouraging lender activities to members of ethnic

communities, especially those vulnerable and disabled” due to “Brexit fears or a result of the recession”.

An FCA spokesman said the regulator was consulting on proposals “to undertake the biggest intervention in the overdraft market in a generation, and we welcome any view on the changes we’ve suggested. “We believe that these changes will provide greater

protection for the millions of people that use overdrafts, particularly the most vulnerable.”

A UK Finance spokesperson, which represents banks, said: “UK Finance members have been working with the regulator to explore new ways to better identify and support customers with repeat overdraft use. We will continue to liaise with the FCA.”

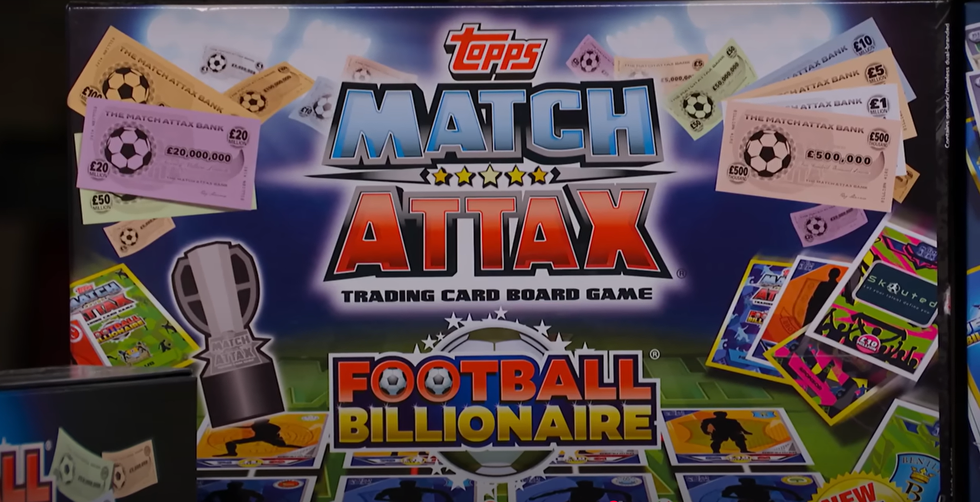

Football-themed board game, Football BillionaireYoutube/ Dragons' Den

Football-themed board game, Football BillionaireYoutube/ Dragons' Den John Caudwell, the billionaire founder of Phones4UInstagram/ johncaudwell

John Caudwell, the billionaire founder of Phones4UInstagram/ johncaudwell