THE inaugural meeting of the UK-India Financial Markets Dialogue (FMD) between senior representatives of both countries was held virtually on Friday (9).

As part of the dialogue, discussions were held to strengthen cooperation on four key themes- Gujarat International Finance Tec (GIFT) City, banking and payments, insurance and capital markets.

The creation of the FMD was agreed at the 10th Economic and Financial Dialogue (EFD) between Finance Minister Nirmala Sitharaman and UK Chancellor Rishi Sunak last year.

The purpose was to deepen financial services cooperation and address regulatory barriers for UK and Indian companies.

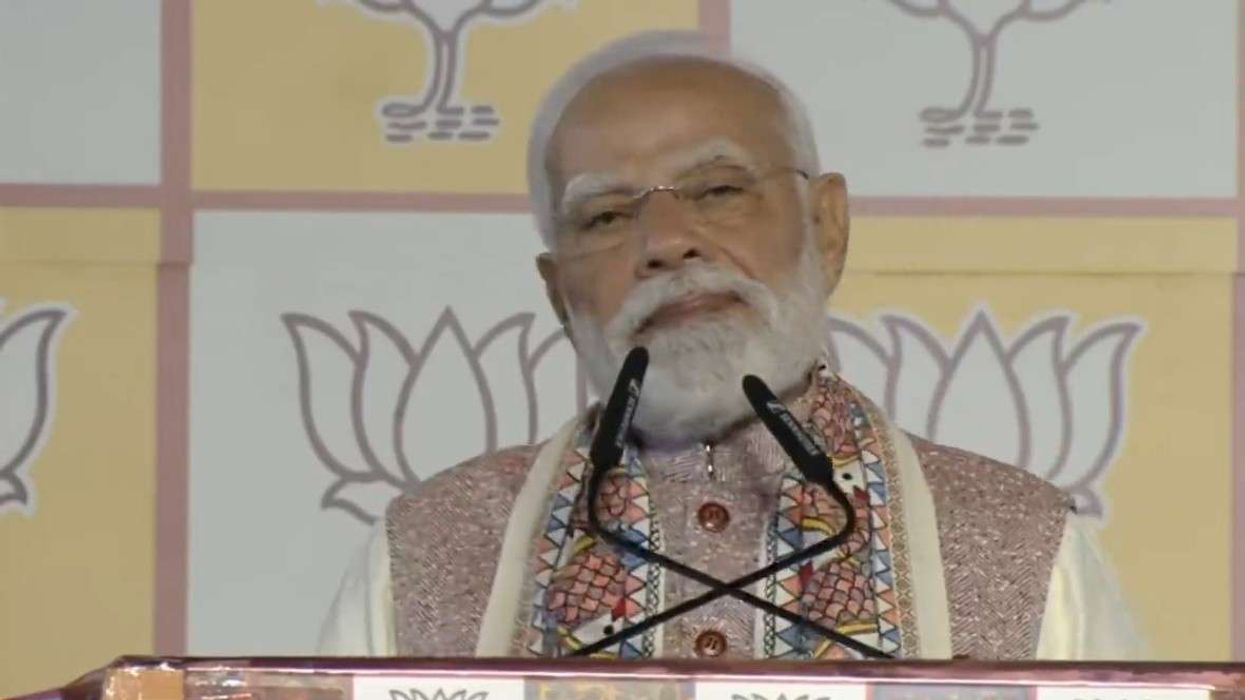

“The 2030 Roadmap agreed by Prime Ministers (Narendra) Modi and (Boris) Johnson aims for a transformation of the UK-India relationship, especially as we look to build back better from Covid-19,” said Alex Ellis, British High Commissioner to India.

“The first Financial Markets Dialogue held today will strengthen links on financial services and create new opportunities for UK and Indian business. I'm pleased to see the strong progress we have already made ahead of the upcoming Economic and Financial Dialogue between our finance ministers,” he said.

The virtual meeting was led by senior officials from the UK treasury department and the Indian ministry of finance, with participation from independent British and Indian regulatory agencies.

The Reserve Bank of India (RBI), the Securities and Exchange Board of India (SEBI), International Financial Services Centre Authority, Insurance Regulatory and Development Authority of India, the Bank of England, and the Financial Conduct Authority (FCA) were also part of the meeting.

"At the meeting, Indian and UK participants discussed progress on the UK-India GIFT City Strategic Partnership. Both sides agreed on areas for further collaboration, including sustainable finance and FinTech, with the aim of supporting increased UK industry presence in the centre," an official statement said.

“Participants provided updates on their respective banking and payments landscapes, with a view to increasing cross-border activity in this area. The Bank of England discussed its work on cyber resilience. Both sides also recognised the key role the banking sector has played in maintaining stability during the Covid-19 pandemic."

The City of London Corporation's Capital Markets Working Group presented its findings on the Indian corporate bond market, and the India-UK Financial Partnership presented recommendations on the UK-India financial services relationship.

Bilateral trade between the UK and India stood at over £18 billion in 2020, with India accounting for the UK’s second-largest source of investment in terms of the number of projects.

In May 2021, Johnson and Modi announced their ambition to double the value of UK-India trade over the next decade as well as a shared intent to begin work towards negotiations on a comprehensive free trade agreement (FTA).

The public consultation for a UK-India FTA was launched on 25 May by International Trade Secretary Liz Truss.

Through the consultation, the UK is engaging closely with businesses and seeking views on doing business with India, which will inform the UK’s approach and mandate. It is expected to conclude on 31 August 2021.