SPORTSWEAR retailer Frasers Group, headed by billionaire Mike Ashley, has demanded a major leadership overhaul at troubled online fashion retailer, Boohoo.

The group, which holds a 27 per cent stake in Boohoo, on Thursday (24) called for an urgent general meeting to vote on appointing Ashley as Boohoo’s new CEO.

This move comes in response to Boohoo’s ongoing difficulties and the recent announcement that its current CEO, John Lyttle, will be stepping down as part of a strategic review, Reuters reported.

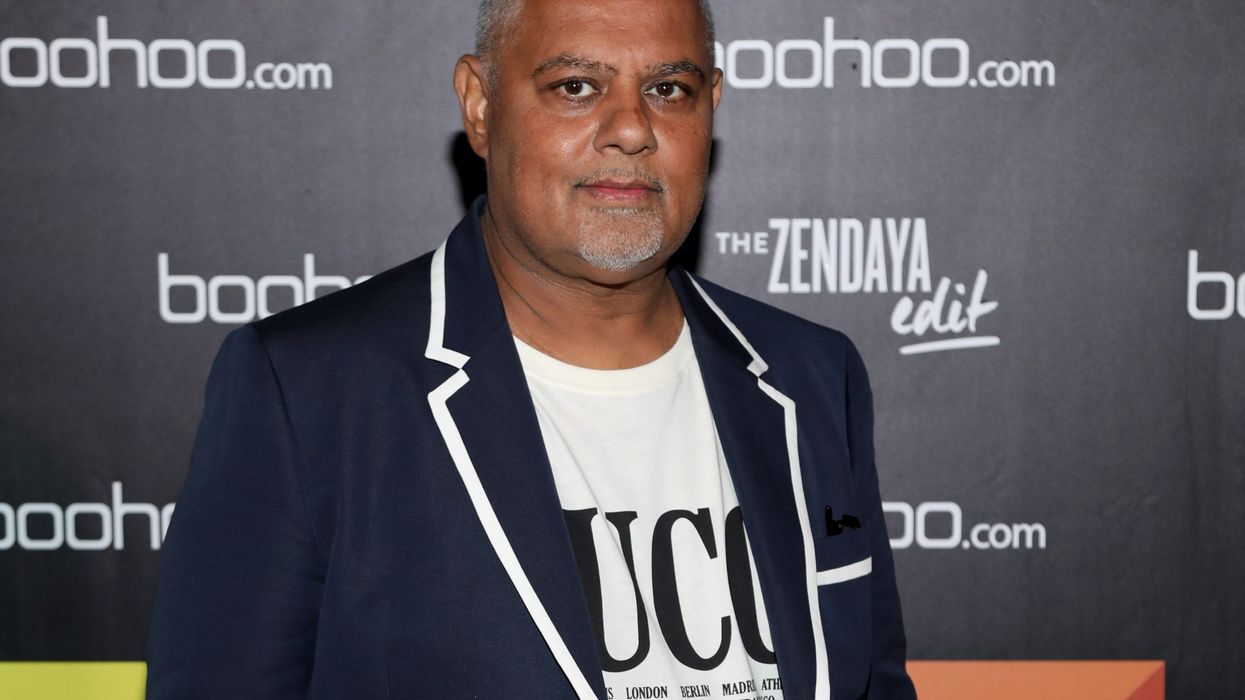

The demand for a leadership change at Boohoo adds another chapter to the longstanding rivalry between Ashley and Boohoo’s co-founder and executive chairman, Mahmud Kamani. The two retail magnates previously clashed in their bids for the failed department store chain Debenhams, which Kamani ultimately secured.

Kamani, who still holds a 12.6 per cent stake in Boohoo, founded the business with Carol Kane in 2006 and took it public in 2014.

In a letter dated 23 October, Frasers criticised Boohoo’s current leadership and described the situation as a “leadership crisis.” The letter, made public by Frasers, argues that Boohoo’s board has lost control of the company and that new leadership is necessary to save the business from further decline.

Frasers insisted that Ashley, who stepped down as Frasers’ CEO in 2022, is the right person to steer Boohoo through its challenges.

In addition to Ashley’s appointment, Frasers recommended bringing in restructuring specialist Mike Lennon as a board member, asserting that the two appointments are “the only way to set a new course for Boohoo’s future.”

The group urged shareholders to support the changes, stating that the company’s current management team has overseen "large-scale value destruction."

Boohoo, a Manchester-based company that owns brands like PrettyLittleThing and Nasty Gal, had once thrived during the pandemic, benefiting from a surge in online shopping.

However, it has since faced a rapid decline in performance, with its share value plummeting by nearly 90 per cent from its peak. Supply chain disruptions, growing competition from fast fashion rivals such as Shein and Temu, and a dip in consumer demand have significantly impacted its revenue.

Currently, Boohoo is battling a tough retail environment, marked by higher costs, more frequent product returns, and intense competition from rivals offering cheaper goods.The retailer struggle to keep up with these competitors has led to significant losses in revenue.

Last week, Boohoo announced a strategic review that could see the company split up. As part of this review, the company also agreed to a debt refinancing deal with its lenders, a move that Frasers has opposed.

Frasers demanded that Boohoo’s board consult with major shareholders, including Sports Direct’s parent company, before making any major decisions, such as selling parts of the business.

Boohoo's board, in response to Frasers' demands, stated that it is "in the process of reviewing the content and validity of the requisitions with its advisers" and promised a further announcement in due course. For now, Lyttle remains in his position as CEO as the company searches for his replacement.