GLOBAL gold demand rose by 4.16 per cent to 1,258.2 tonnes during the April-June period, driven primarily by strong over-the-counter (OTC) transactions. This made it the strongest second quarter for gold demand in a calendar year, according to a report by the World Gold Council (WGC) released on Tuesday (30).

The WGC's Q2 2024 Gold Demand Trends report revealed that in the second quarter of 2023, total demand stood at 1,207.9 tonnes. The increase was significantly supported by a 53 per cent year-on-year rise in OTC transactions, which reached 329 tonnes during the June quarter.

Simultaneously, the quarter under review also witnessed an 18 per cent year-on-year growth in gold prices that averaged $2,338 (£1,817.78) an ounce, reaching a record of $2,427 (£1,886.98) an ounce during the quarter, said the report. Increased OTC demand, continued buying from central banks, and a slowdown in ETF outflows drove record-high gold prices in the second quarter this year, it added.

Central banks and official institutions increased global gold holdings by 183 tonnes, slowing down from the previous quarter but still reflecting a 6 per cent increase year-on-year.

"Our annual central bank survey confirmed that reserve managers believe gold allocations will continue to rise over the next 12 months, driven by the need for portfolio protection and diversification in a complex economic and geopolitical environment," said the report.

Global gold investment remained resilient, marginally higher year-on-year at 254 tonnes, concealing divergent demand trends. Bar and coin investment decreased by 5 per cent to 261 tonnes in the April-June period due to a sharp decline in demand for gold coins. Strong retail investment in Asia was counterbalanced by lower levels of net demand in Europe and North America, where profit-taking surged in some markets.

The report also revealed that global gold ETFs (exchange-traded funds) saw minor outflows of 7 tonnes during the quarter. Asian growth continued, with sizable European outflows in April turning into nascent inflows in May and June, and North American outflows slowing significantly compared to the previous quarter.

Record high prices drove down jewellery demand by 19 per cent year-on-year in the second quarter, but during the first half of this year (January-June), demand remained resilient compared to the same period last year, mainly due to a stronger-than-expected first quarter.

Additionally, demand for gold in technology continued to increase, jumping 11 per cent year-on-year, driven primarily by the AI boom in the electronics sector, which saw a 14 per cent increase year-on-year. Total gold supply also went up by 4 per cent, with mine production increasing to 929 tonnes. Recycled gold volumes increased by 4 per cent, marking the highest second quarter since 2012.

WGC Senior Markets Analyst Louise Street said the rising and record-breaking gold price made headlines as strong demand from central banks and the OTC market supported prices.

"The OTC market has seen continued appetite for gold from institutional and high-net-worth investors, as well as family offices, as they turn to gold for portfolio diversification. On the other hand, demand from jewellery tumbled last quarter as prices continued to hit highs, which also tempted some retail investors to take profit," she said.

"While there are potential headwinds for gold ahead, there are also changes taking place in the global market that should support and elevate gold demand," she added.

'India's duty cut to revive gold demand after weak quarter'

Meanwhile, India's gold demand in the June quarter fell 5 per cent from a year ago, but consumption in the second half of 2024 is set to improve due to a correction in local price following a steep reduction in import taxes, the World Gold Council (WGC) added.

Higher purchases in the world's second-biggest gold consumer could support global benchmark prices, which are trading near record highs.

The recent 9 per cent point reduction in import duty on gold, implemented before the main festival season beginning in September, is expected to revive gold demand, further supported by good monsoon rains, said Sachin Jain, CEO of WGC's Indian operations.

India last week slashed import duties on gold to 6 per cent from 15 per cent, a move industry officials said could lift retail demand and help cut smuggling.

The duty cut brought down domestic prices of gold MAUc1 last week to ₹67,500 (£626.97) per 10 grams, their lowest in four months, from a record high of ₹74,777 (£694.69) earlier this month.

Good monsoon showers boost food grain production and improve farmers' income. Two-thirds of India's gold demand usually comes from rural areas, where jewellery is a traditional store of wealth.

"Strong gross domestic product forecasts and rural sector recovery are all likely to support demand in the second half of the year," WGC's Jain said.

India's gold consumption in the April-June quarter fell 5 per cent to 149.7 metric tonnes, as a 17 per cent fall in jewellery demand offset a 46 per cent rise in the investment demand during the quarter, the WGC said.

Demand for gold from India could stand between 700 metric tonnes and 750 metric tonnes in 2024, the lowest in four years, it said.

The Reserve Bank of India continued its gold buying spree in the June quarter, adding 19 tonnes, which brought its total purchases for the first half of the year to 37 tonnes, more than double the total purchased in all of 2023, the WGC said.

(With inputs from PTI and Reuters)

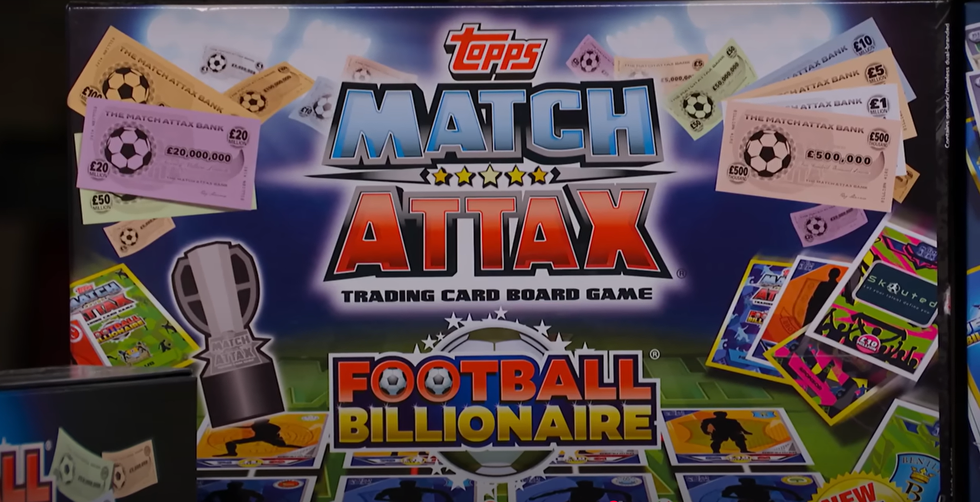

Football-themed board game, Football BillionaireYoutube/ Dragons' Den

Football-themed board game, Football BillionaireYoutube/ Dragons' Den John Caudwell, the billionaire founder of Phones4UInstagram/ johncaudwell

John Caudwell, the billionaire founder of Phones4UInstagram/ johncaudwell