GOLD demand will win a “pronounced” boost from geopolitical uncertainty this year, an industry report predicted last Wednesday (31), after the precious metal and haven investment hit a record-high price in 2023.

The World Gold Council said the commodity would in 2024 continue to benefit from strong buying by central banks, which would help to offset a slowdown in consumer demand owing to elevated prices and weaker economic growth.

The price of gold hit an all-time high at $2,135.39 (£1,695.3) an ounce at the end of 2023, which sent demand sliding.

Gold demand retreated 12 per cent in the final quarter – and by five per cent over the year to 4,448 tonnes, WGC said.

The record price reached in December was in large part owing to the Israel-Hamas war, according to analysts. It gained also from traders increasingly betting on the Federal Reserve cutting US interest rates this year, which dented the dollar.

A weaker greenback makes dollar-denominated gold cheaper for holders of other currencies. “Unwavering demand from central banks has been supportive of gold,” noted Louise Street, senior markets analyst at WGC.

“In addition to monetary policy, geopolitical uncertainty is often a key driver of gold demand and in 2024 we expect this to have a pronounced impact on the market.

“Ongoing conflicts, trade tensions and over 60 elections taking place around the world, are likely to encourage investors to turn to gold for its proven trackrecord as a safe haven asset.”

WGC said mine production rose one per cent last year. Recycling of the metal increased nine per cent, which was lower than expected given the high price.

Despite record-high prices, “the global jewellery market proved to be remarkably resilient ... as demand inched up by three tonnes year-on-year”, said WGC.

“China played an important role, recording a 17-per cent increase in demand, as it recovered from Covid-19 lockdowns.”

This offset a nine-per cent decline in India’s demand for gold jewellery, it added.

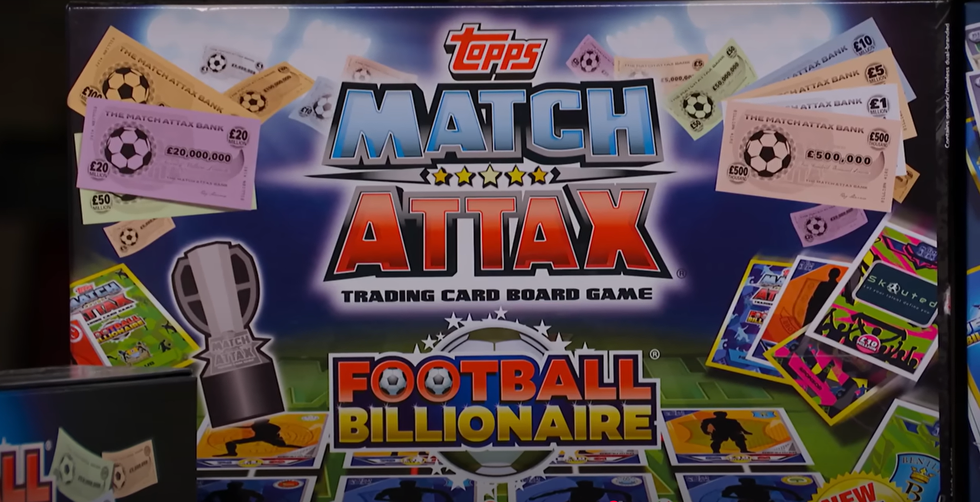

Football-themed board game, Football BillionaireYoutube/ Dragons' Den

Football-themed board game, Football BillionaireYoutube/ Dragons' Den John Caudwell, the billionaire founder of Phones4UInstagram/ johncaudwell

John Caudwell, the billionaire founder of Phones4UInstagram/ johncaudwell