The International Monetary Fund (IMF) has reached an agreement with Pakistan on a new £1 billion loan programme and reviewed an existing bailout, which could unlock an additional £770 million if approved.

The IMF said in a statement on Tuesday that the 28-month agreement aims to support Pakistan’s efforts in tackling climate change.

Both the new loan programme and the review of the existing bailout require approval from the IMF’s executive board, which is expected to give its final clearance.

Pakistan faced a risk of default in 2023 due to an economic downturn and political instability, leading to a significant debt burden.

A £5.4 bn bailout from the IMF helped stabilise the economy, with inflation easing and foreign exchange reserves improving.

However, the agreement—Pakistan’s 24th since 1958—came with conditions, including increasing income tax revenue and reducing power subsidies to address inefficiencies in the energy sector.

On Tuesday, the IMF stated that Pakistani authorities remained "committed to advancing a gradual fiscal consolidation to sustainably reduce public debt," alongside measures such as tight monetary policy, cost-cutting, and economic reforms.

The agreement in principle also covers the second review of the existing 37-month programme.

If approved by the IMF’s executive board, Pakistan will receive fresh funds worth approximately £770m. This would bring total disbursements under the current programme to around £1.54 bn, the Fund said.

"Over the past 18 months, Pakistan has made significant progress in restoring macroeconomic stability and rebuilding confidence despite a challenging global environment," IMF mission chief Nathan Porter said in a statement.

(With inputs from AFP)

Damian Talbot

Damian Talbot

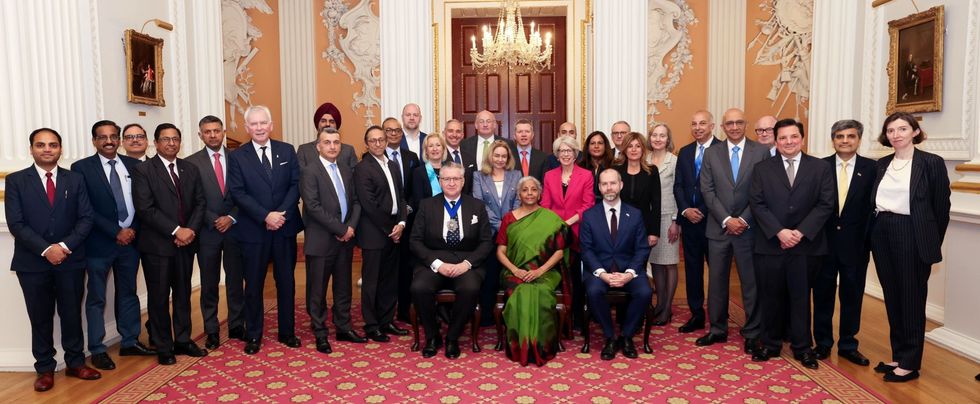

Nirmala Sitharaman speaks at the India-UK Investor Roundtable in London last Wednesday (9). On the panel were India’s department of economic affairs secretary Ajay Seth and Kotak Mahindra Bank founder Uday Kotak

Nirmala Sitharaman speaks at the India-UK Investor Roundtable in London last Wednesday (9). On the panel were India’s department of economic affairs secretary Ajay Seth and Kotak Mahindra Bank founder Uday Kotak Sitharaman with Sir Keir Starmer and Rachel Reeves

Sitharaman with Sir Keir Starmer and Rachel Reeves Sitharaman with Jonathan Reynolds

Sitharaman with Jonathan Reynolds  Sitharaman with Reynolds, Alastair King, India’s high commissioner Vikram Doraiswami and other delegates

Sitharaman with Reynolds, Alastair King, India’s high commissioner Vikram Doraiswami and other delegates