THE Bank of England’s actions to tame inflation have just begun to impact households and the effects will be felt to a greater extent next year, a policymaker has said.

Last month, the central bank froze interest rates at 5.25 per cent following a surprise slowdown in inflation.

Its decision to hold borrowing costs at the highest level in more than 15 years followed 14 straight hikes after global inflation soared to the highest levels in decades.

Britain’s economy expanded in August by 0.2 per cent up from a contraction of 0.6 per cent in July, Office for National Statistics data showed.

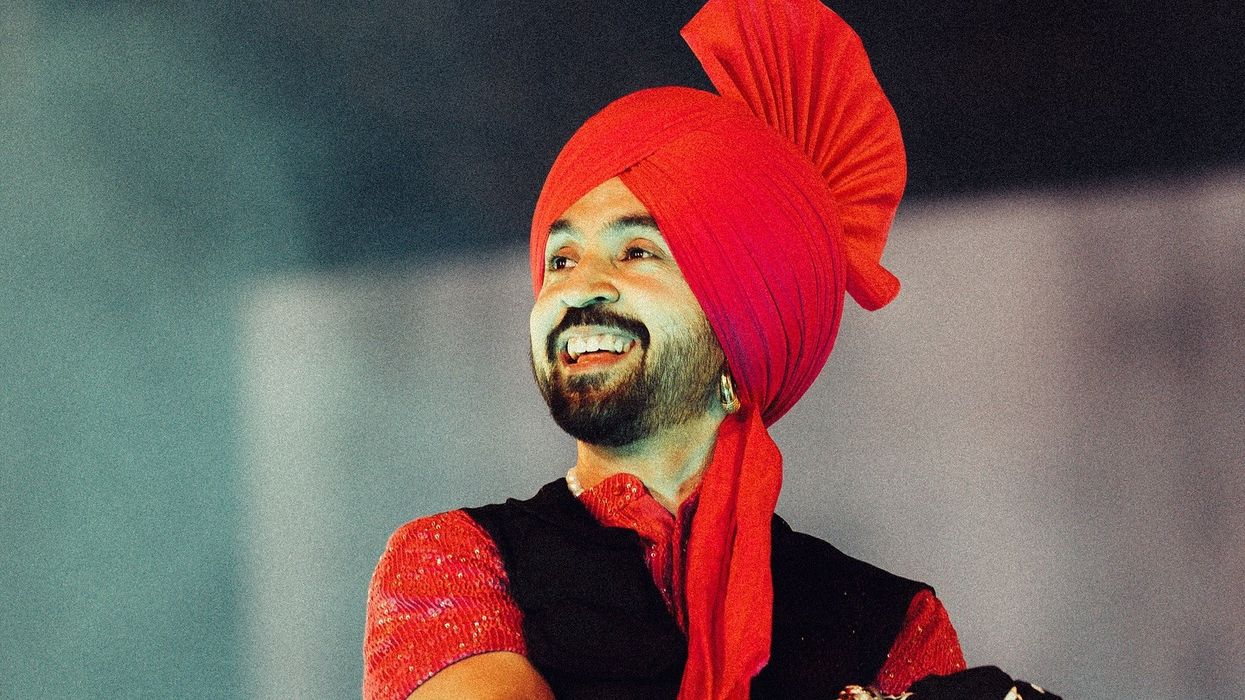

The BoE’s Monetary Policy Committee member Swati Dhingra said interest rates were expected to remain high for some time and this would affect millions of households - mostly young and poor - next year.

“We think only about 20 per cent or 25 per cent of the impact of the interest rate hikes have been fed through to the economy,” she told the BBC.

“I think that there’s also this worry that that might mean that we’re going to have to pay a higher cost than we should be paying.”

Britain’s economy “has already flatlined”, according to the associate professor at the London School of Economics, who obtained her master’s degree from the University of Delhi and her PhD from the University of Wisconsin-Madison.

Dhingra, who was appointed to the central bank’s interest rate setting committee in August last year, said high food and energy costs disproportionately affected low-income groups, while the increase in mortgage costs and rents hit young people.

She said the GDP growth in August was too small to avert a recession.

“When you’re growing as slowly as we’re growing now, the chances of recession or not recession are going to be pretty equally balanced. So we should be prepared for that … it’s not going to be great times ahead,” Dhingra said.

Earlier this week, the central bank noted that the outlook for global economic growth remained “weak in the near term”.

It warned that interest rates “may need to rise further" if inflation remained stubborn.

Impact of high interest rates will be felt more 'next year'

About a quarter of the impact of the interest rate hikes have been fed through to the economy: Swati Dhingra

Ten million stories of migration to Britain