INDIA’S multi-billion-dollar purchases of US arms are less about shifting its reliance on Russian defence equipment and moving towards the West - it’s more about developing its own domestic weapons industry, security officials and analysts say.

India is the world’s biggest arms importer, but almost all of its major weapons purchases now include provisions for joint manufacture or technology transfer, irrespective of which country it is dealing with.

Also, Russia’s war in Ukraine has disrupted some military supplies to India, reinforcing New Delhi’s long-term desire to diversify imports or replace them with home-built hardware, Indian defence officials said.

India bought weapons worth more than $60 billion (£46bn) in the last 20 years, of which 65 per cent or nearly $39bn (£30bn) were from Russia, according to Stockholm International Peace Research Institute data.

Defence minister Rajnath Singh said India intends to order weapons from the domestic arms industry worth over $100bn (£77bn) over the next decade.

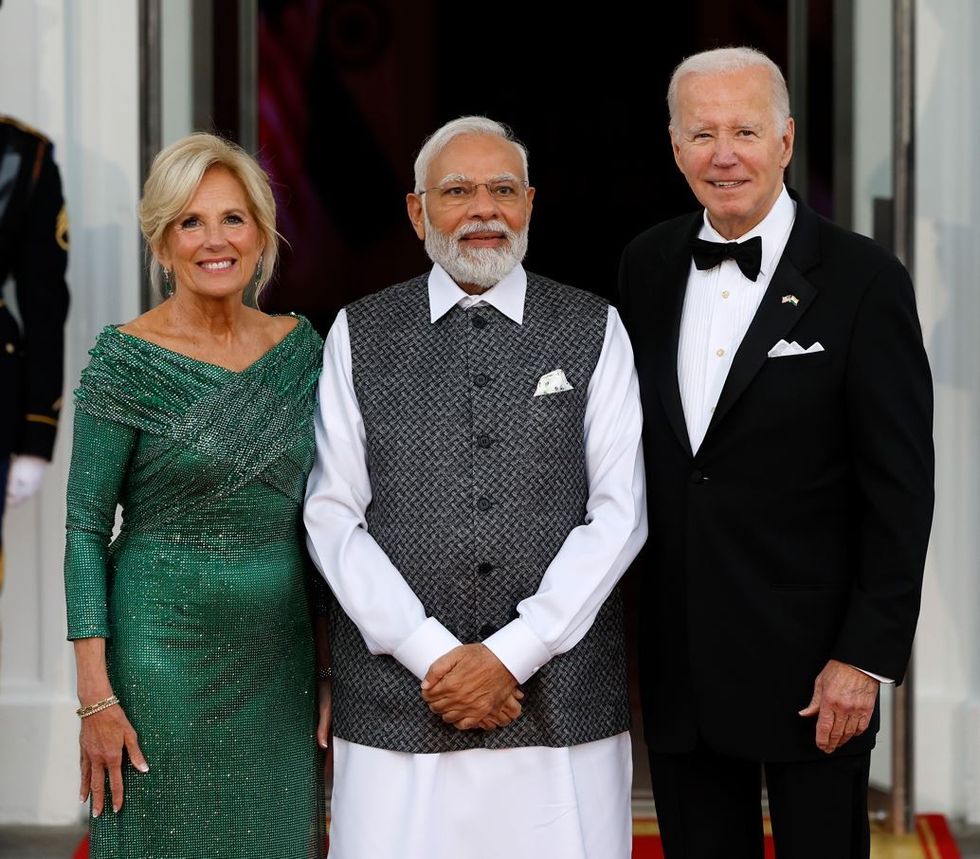

“It is a reality, that we have to reduce dependence on Russia,” said a senior Indian defence officer working on future capabilities of the Indian military, who declined to be identified. “But that is part two. The part one is the effort to get out of the import business.” India announced significant purchases of US defence equipment during prime minister Narendra Modi’s state visit to Washington last month, including an order worth more than $1bn (£770m) for GE engines for fighter jets.

A possible $3bn (£2.3bn) billion deal for MQ-9B SeaGuardian drones is also being discussed. In line with New Delhi’s desire for self-reliance in defence and Modi’s flagship “Make in India” policy, the jet engine deal includes joint manufacturing in the future, while the assembly and maintenance of the SeaGuardians will likely be in India.

The US ambassador to India, Eric Garcetti, said Washington had earlier paid “lip service”, but was now easing India’s access to military technologies. He said the US was “leaning in with technology” sharing more with India than it had with some its closest allies.

However, the moves so far will not be sufficient to end New Delhi’s reliance on Russia while stringent US rules governing the sharing of military technology limit future possibilities for now.

“Nobody gives you everything. They keep you at least a screwdriver away from having it fully,” said a second senior official from India’s defence ministry, who also spoke on condition of anonymity.

Arzan Tarapore, an Indian security expert at Stanford University, said the deals announced during Modi’s visit “do not in themselves represent an Indian shift away from Russia.”

“A big shift away from Russia will take multiple decades,” he said.

India still uses mostly Russian technology for traditional arms. Tarapore said the biggest potential for US-India collaboration should be on new systems that India doesn’t already have. Delhi’s main aim is to narrow the technological gap with better-armed neighbour China, with which it has a tense relationship, and which is also closely allied with Pakistan.

One problem for India is that Russia’s war in Ukraine has hit Moscow’s ability to deliver weapons and equipment.

India’s Air Force recently informed a parliamentary panel that Russia would delay deliveries of spares for Sukhoi Su30 MKI and MiG-29 jet fighter planes. A big-ticket item, believed to be the remaining two of the five Russian S-400 air defence systems India bought for nearly $5.5bn (£4.2bn) in 2018, has also been delayed, it said.

India has also been expecting to receive two nuclear-powered attack submarines from Russia over the next few years, but these might also be delayed, defence officials said. Such problems have reinforced India’s resolve to become less dependent on Russia, but it does not want to rely on any one nation for its weapons purchases, they said.

It is buying French fighter jets, Israeli drones, American jet engines and potentially German submarines. Over time these purchases will reduce the share of Russian military technology used by India, but this would take at least two decades, Indian officials said.

Bill Greenwalt, a former senior Pentagon official for industrial policy, said the days of US and Russian domination of the global defence market and being able to control defence technology was coming to end, but what would replace it was “still a work in progress.”

He said India could become frustrated by the strict US export control system for armaments and the restrictions it places both on technology sharing and its ability to develop systems it acquires. “I expect India will pursue cooperation with the west with those countries that can transfer technology,” he said.

Exports to India must satisfy stringent US International Trafficking in Arms (ITAR) regulations and the two countries are not treaty allies - which for instance means the level of technology sharing provided under the AUKUS deal to supply Australia with nuclear-powered submarines is not on the cards.

Even so, Modi’s US visit has been hailed by both sides as bringing the relationship to a new level. Besides the defence deals, the two countries also signed agreements on chips, space, artificial intelligence and critical minerals.

India is also a member of the QUAD alliance with the US, Japan and Australia, which deepens its ties with the West, but does not replace its decades-old relationship with Russia.

Derek Grossman, a Rand Corporation defence analyst, said the US would always be cautious in what military hardware and technology it shares with India because of this.

Even if India can transition away from Moscow over the next few decades, Grossman said, “the US will still have suspicions about how their systems are being used and how that might help the Russians in some sort of way, because of that close India-Russia partnership.”

“India is going to be opportunistic in this situation and accept whatever the US is willing to offer. But I don’t think they are willing to give up what they have with Russia.” (Reuters)