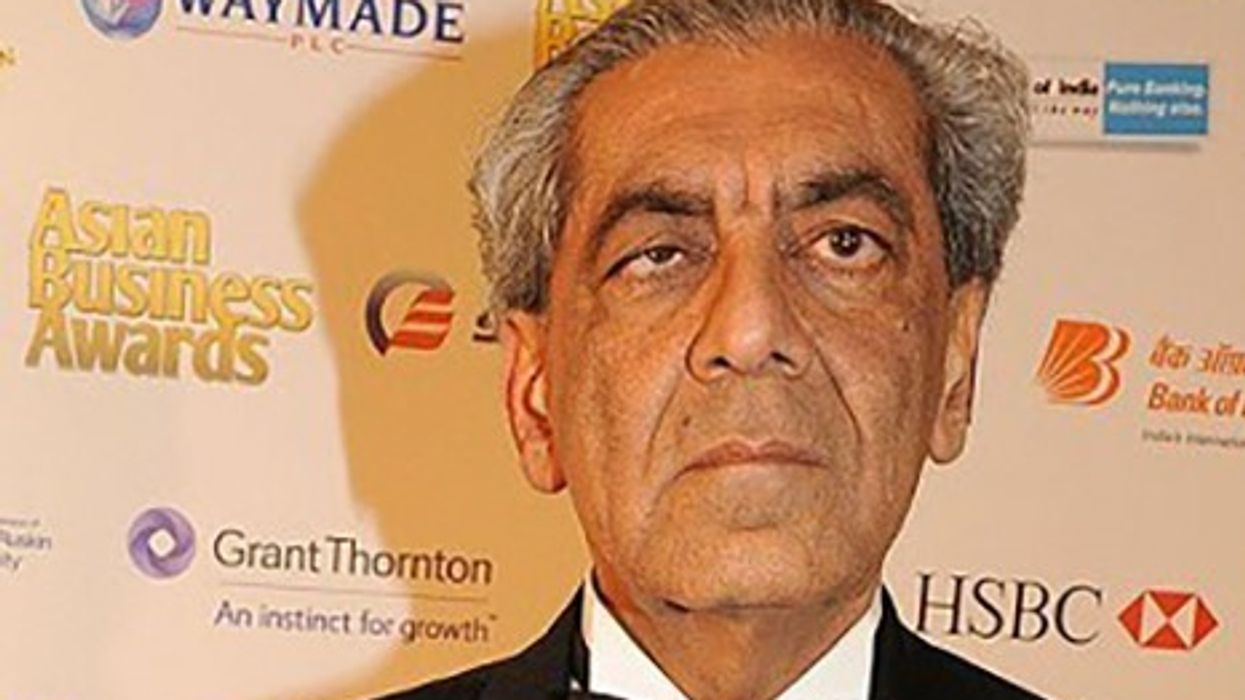

A consortium of Indian banks has returned to the High Court in London for a bankruptcy application hearing against liquor tycoon Vijay Mallya.

The consortium led by the State Bank of India (SBI) pursue the recovery of debt from loans paid out to Mallya's now-defunct Kingfisher Airlines.

At a virtual hearing before Chief Insolvencies and Companies Court (ICC) Judge Michael Briggs, both sides deposed retired Indian Supreme Court justices as expert witnesses on Indian law in support of their arguments.

While the banks argued a right to waive their security over the Indian assets involved in the case in order to recover their debt in the UK, Mallya's lawyers argued that the funds in question involved public money held by state-owned banks in India which precluded them from such a security waiver.

"As a commercial entity, a bank has a right to exercise its commercial wisdom to decide what it wants to do with its security,” said barrister Marcia Shekerdemian, arguing on behalf of SBI and others.

She cross-examined Retd Justice Deepak Verma, who deposed via video link from India on behalf of Mallya to establish that the banks cannot give up their security on the Indian assets.

The banks can not pursue a bankruptcy order under English law because public money and public interest is involved in the case in India, he said

Retd Justice Gopala Gowda argued the reverse in his cross-examination by Mallya's barrister Philip Marshall, saying the banks had a right to relinquish their security in pursuit of unpaid dues.

The exchange between the lawyers got heated and Judge Briggs stepped in to urge a focussed question and answer approach to expedite the proceedings.

However, the case has now been adjourned to a yet-to-be-agreed date in 2021.

Meanwhile, Marshall once again raised the issue of access to court-held funds from the sale of a French property for Mallya to be able to cover the legal fees of the next hearing as he no longer has a source of income from his consultancy work.

The consortium include Bank of Baroda, Corporation Bank, Federal Bank Ltd, IDBI Bank, Indian Overseas Bank, Jammu & Kashmir Bank, Punjab & Sind Bank, Punjab National Bank, State Bank of Mysore, UCO Bank, United Bank of India and JM Financial Asset Reconstruction Co. Pvt Ltd. It had initiated the proceedings against Mallya in December 2018.

There have been a series of hearings in the case since then as part of their efforts to recoup around £1.145 billion in unpaid loans.

Mallya, meanwhile, remains on bail as the UK Home Office deals with a 'confidential' legal issue before UK home secretary Priti Patel can sign off on his extradition sought by the Indian government..