ONLINE bank Zopa has received a £68 million funding boost, led by AP Moller Holding, the owners of shipping giant Maersk.

The new investment aims to support Zopa’s growth plans, including the launch of a current account and further advancements in artificial intelligence (AI), the Times reported.

Founded in 2005, Zopa initially pioneered peer-to-peer lending but transitioned to a traditional banking model in 2020. Today, the bank serves over 1.3 million customers, manages £5 billion in deposits, and has lent more than £13bn to UK consumers.

Chief executive Jaidev Janardana revealed that the funding will help Zopa meet regulatory capital requirements as it continues to grow at a rapid pace. He highlighted plans to introduce investment ISAs and a new current account in the coming year.

An Individual Savings Account (ISA) allows you to invest in options like shares, funds, investment trusts, or bonds. These are typically managed through a stocks and shares ISA, also known as an investment ISA.

“A lot of banking now is done on a small rectangle. We are looking at how AI can take us beyond mobile apps and into more voice-based banking, making that interaction simpler and bringing back some warmth," he was quoted as saying.

He added that AI could also help customers “make better choices” on their finances by helping people manage the multiple financial services providers most consumers have.

The bank reported its first pre-tax profit of £15.8m in 2023, driven by higher net interest income. It anticipates doubling profits in 2024, supported by a projected 35 per cent increase in annual revenue.

AP Moller Holding, also a shareholder in Danske Bank, is among Denmark’s largest investors with $32bn in assets. The report revealed that Zopa’s largest stakeholder, IAG SilverStripe, a specialist in financial services investments, also participated in the latest funding round.

With about 850 employees, Zopa has benefitted from rising net interest income in recent years. However, Janardana welcomed the possibility of central bank rate cuts, noting it could stimulate demand for the bank’s lending products.

The investment will also fuel Zopa’s push into generative AI technologies, which underpin tools like ChatGPT. This innovation aims to “reinvent how people interact with their money,” according to the company.

Purushottam Agrawal and Linda Hess in conversation with Sanjoy K Roy

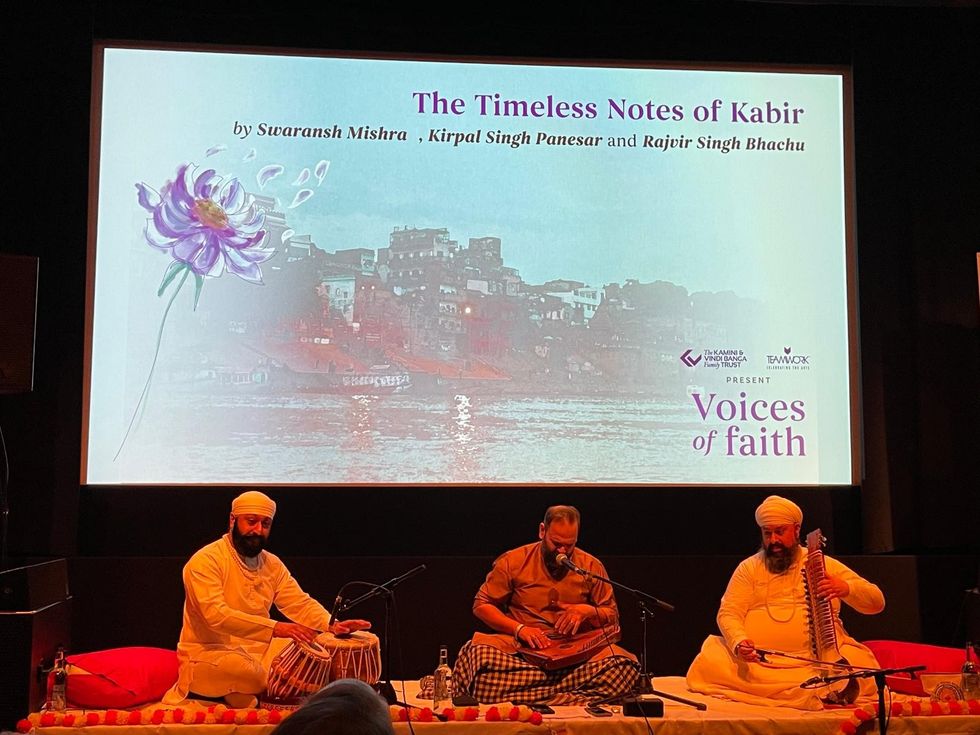

Purushottam Agrawal and Linda Hess in conversation with Sanjoy K Roy Swaransh Mishra, Kirpal Singh Panesar and Rajvir Singh Bhachu

Swaransh Mishra, Kirpal Singh Panesar and Rajvir Singh Bhachu

A resident in Odessa, Ukraine, as smoke rises from a fire following a strike earlier this month amid the Russian invasion

A resident in Odessa, Ukraine, as smoke rises from a fire following a strike earlier this month amid the Russian invasion

Manmeet K Walia

Manmeet K Walia Salima Hashmi

Salima Hashmi Tikri Border, Haryana-Delhi by Aban Raza

Tikri Border, Haryana-Delhi by Aban Raza