PRIME MINISTER Sir Keir Starmer and chancellor Rachel Reeves met business leaders on Tuesday (28) to announce pension sector reforms that they hope will boost economic growth and investment.

Starmer and Reeves held the meeting in London’s finance centre with leading chief executives including Lloyds Banking Group’s Charlie Nunn, BT’s Allison Kirkby, Tesco’s Ken Murphy and BAE Systems’ Charles Woodburn, the government said.

At the meeting, Starmer and Reeves announced plans to release and reinvest corporate pension surpluses worth over £100 billion.

“To achieve the change our country needs requires nothing short of rewiring the economy,” Starmer said in a statement before the meeting. “It needs creative reform, the removal of hurdles, and unrelenting focus.”

The meeting came before the chancellor’s major speech on Wednesday (29), where she was set to outline plans to revive Britain’s stagnant economy.

That speech was likely to be closely watched after a rise in global borrowing costs earlier this month demonstrated how tight Britain’s public finances are. This led to speculation that Reeves may need to cut spending or raise taxes to keep to her self-imposed rules that limit borrowing.

Reeves and Starmer promised voters ahead of last July’s election that they would turn Britain into the fastest-growing Group of Seven economy.

But since Labour took power, the economy has lost momentum with many employers blaming Reeves’ first budget plan which included an increase in the tax burden on businesses.

The new plan will allow the pension surpluses to be reinvested back into companies or used to provide better employee benefits, rather than kept in safer but lower-return assets such as government bonds.

Downing Street said about 75 per cent of corporate defined-benefit pension schemes are in surplus, worth £160bn, but restrictions have meant that businesses have struggled to invest them.

A report by industry body Pensions and Lifetime Saving Association last year broadly supported more surplus sharing, but said surpluses could change based on market fluctuations.

In an interview last Thursday (23), the chancellor told Reuters she will announce changes if necessary in March to meet her fiscal rules, but added that it was important not to “jump the gun” with two months still to go.

“We’ve asked the independent Office of Budget Responsibility to do a forecast that will be published on March 26 and at that point, I’ll be setting out any changes that are necessary,” Reeves said in an interview on the sidelines of the World Economic Forum’s annual meeting in Davos, Switzerland. “I don’t think we should jump the gun. (There’s) another two months before the OBR produce their forecast.”

Media reports have previously said Reeves is more likely to cut spending rather than raise taxes after a sharp increase in social security contributions paid by employers, which she announced last year and is due to start in April.

Earlier this month, a sharp sell-off in British government bonds, driven to a large degree by shifts in US interest rate expectations ahead of the inauguration of president Donald Trump, forced Reeves to say she would act to meet her fiscal rules if needed.

Market borrowing costs have fallen back in the last week and as of last Thursday, British gilts were the third best-performing bonds among the Group of Seven countries this year.

“Just looking at what’s happened year to date, we’re in line with our peers to just look at bond yields,” Reeves said. On the spike in yields earlier in the month, Reeves said: “It’s not a UK phenomenon. It’s not a targeting of the UK.”

Since her October 30 budget that raised borrowing and increased tax on employers to restore public services and investment, economic data has largely turned against Reeves, adding to the likelihood that she will need to do more to meet her rules.

These include balancing day-to-day spending with revenues by the end of the decade and for public sector net financial liabilities to fall as a proportion of gross domestic product. “We are taking out those barriers that have stopped businesses investing and growing in Britain,” Reeves said. “I am confident that we can get those growth numbers up.”

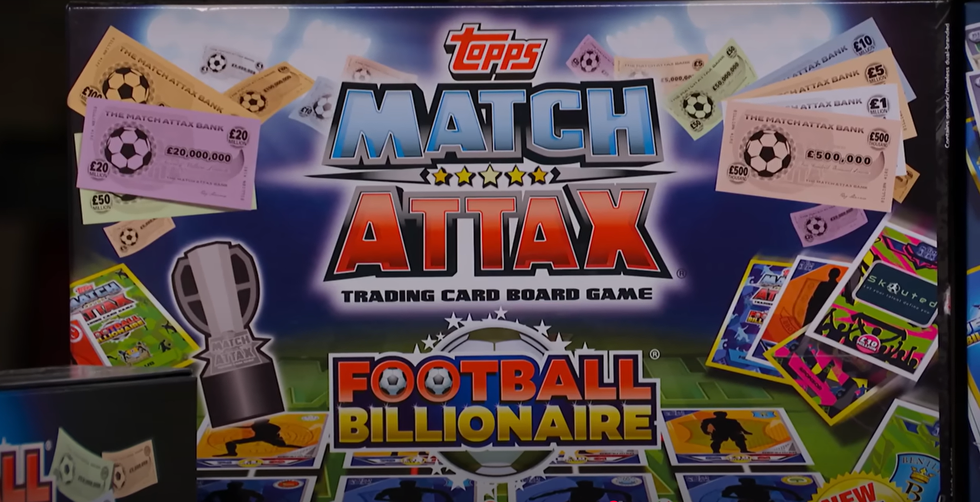

Football-themed board game, Football BillionaireYoutube/ Dragons' Den

Football-themed board game, Football BillionaireYoutube/ Dragons' Den John Caudwell, the billionaire founder of Phones4UInstagram/ johncaudwell

John Caudwell, the billionaire founder of Phones4UInstagram/ johncaudwell