One of the richest south Asian industrialists in the UK has told Eastern Eye that at least 30 companies have approached him for financial investment.

Speaking to Eastern Eye, the peer said he was willing to plough “several hundred million pounds” into a company.

“I’d like to invest in engineering firms which are profitable,” he said. “I don't want to buy a business where they can't make money.

“I would like to buy a business where there is a possibility of expansion [to make] even more money than I originally invested.”

“I most like engineering steel, metals etc., and I will look at anything which I can understand, because I like to manufacture.”

Some may be surprised that the entrepreneur wants to invest in steel after parts of Caparo Industries steel operations went into administration in 2015 during a global collapse in the market.

“[The losses] are why I want to come back, because steel, and every commodity, go up and down,” said Paul.

No slowing down

At the time there were complaints that Chinese manufacturers undercut steel prices which contributed to the market’s problems.

“China find themselves in trouble themselves after cutting down too much.

“On the other hand, they are still the cheapest. They compete with India even more, because India is able to compete with them, but they to live with that.”

The magnate will turn 91 next month, and he refuses to slow down.

“That makes me ask why not spend my life to do more good,” he explained.

“Good by my family, good to the world, good to the industry, good to the workers.

“That is what keeps me driving.

“If I don't do anything, I'll be a dead man, I'll be suffering in the house, one pain or the other and some sadness.

“If your grandchild falls ill, you are worried. If your wife gets a headache, you get complaints. You feel that you are more ready to take the aspirin than even she is.

“Those are the kind of things which drive me, and I enjoy it.”

Paul keeps busy, despite his age. He is up and working when the markets open in India, makes sure his UK concerns are operating properly, and he is still there when Wall Street closes.

For a journalist of 40-plus years standing, I found his stamina while writing this story to be indefatigable.

Taking opportunities

Over the course of three weeks, Paul phoned repeatedly wanting, to make sure that I got everything I needed, and that I understood the details necessary to compile a business story.

That eye for detail, the necessity to make sure everything is factually correct, are things the peer hopes to pass onto his grandchildren.

“My granddaughter whose birthday is tomorrow, and she'll become 16, I was telling her, you will find in life the more you work, the more you enjoy.

“Let nobody make you believe that not doing anything, or playing this or that, is better.”

The Caparo empire has businesses in India, the United Arab Emirates, the USA, and of course in Britain.

And their owner never misses a business opportunity.

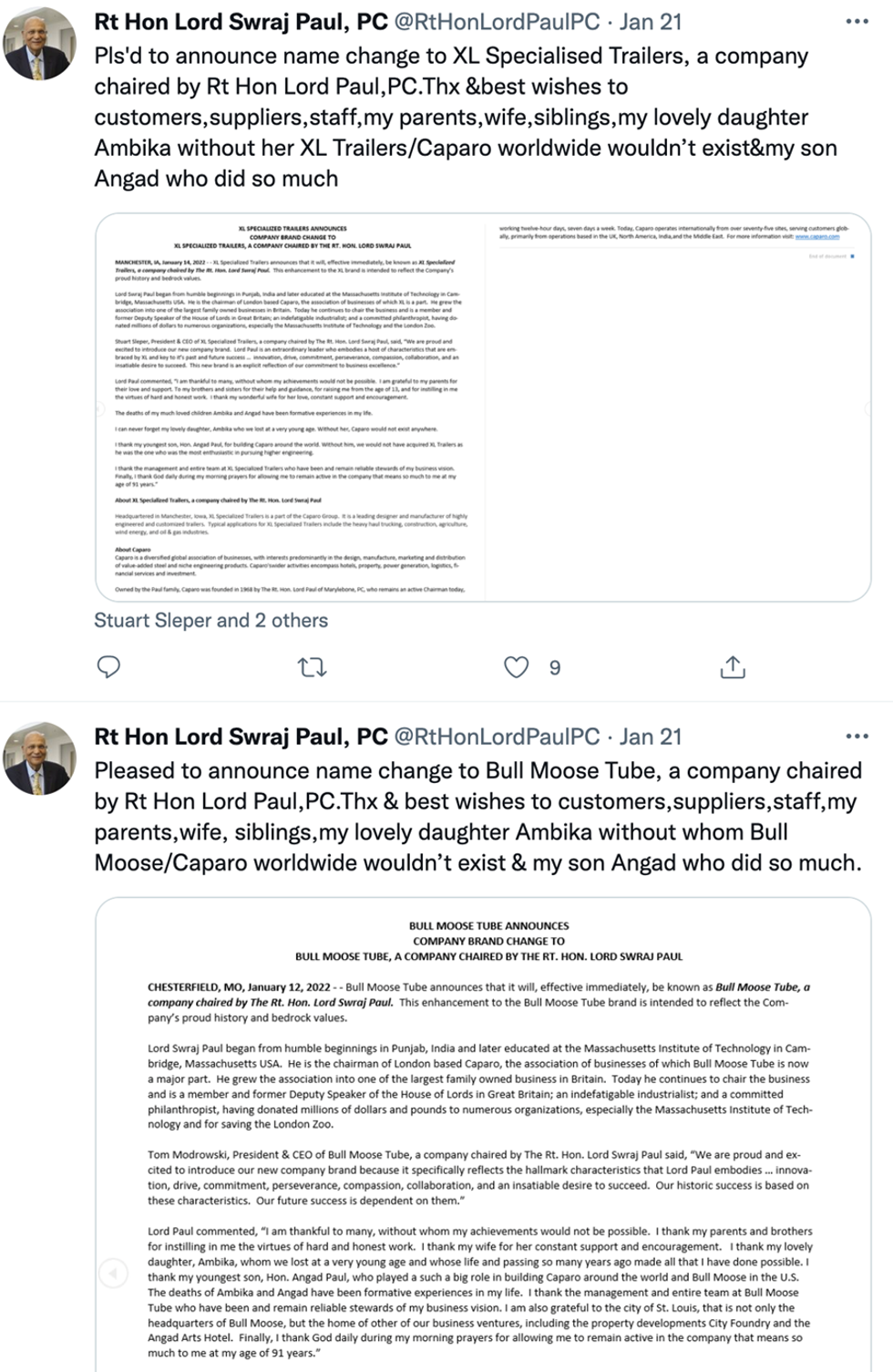

Paul knows he is the brand, and that is why last week (21), he Tweeted that he was changing the names of his American companies.

Bull Moose Tubes, in Chesterfield Missouri, and its six plants in America, and one on Canada, will now have the tag line of “a company chaired by The Rt. Hon. Lord Swraj Paul”.

President and CEO, Tom Modrowski said, “We are proud and excited to introduce our new company brand because it specifically reflects the hallmark characteristics that Lord Paul embodies, innovation, drive, commitment, perseverance, compassion, collaboration, and an insatiable desire to succeed.

“Our historic success is based on these characteristics. Our future success is dependent on them.”

Branding

It is also the same for XL Specialized Trailers, based in Manchester, Iowa.

The company’s website declares it is “a leading designer and manufacturer of highly engineered and customized trailers for applications in the heavy haul trucking, construction, agriculture, wind energy, and oil & gas industries.”

When you read the press release, you will be struck by the peer’s words.

“I thank my lovely daughter, Ambika, whom we lost at a very young age and whose life and passing so many years ago made all that I have done possible.

“I thank my youngest son, Hon. Angad Paul, who played a such a big role in building Caparo around the world and Bull Moose in the U.S.

“The deaths of Ambika and Angad have been formative experiences in my life.

These acknowledgements add to the Paul legacy, for it was the fight to keep his daughter, Ambika, alive that brought the entrepreneur to the UK.

He has been here ever since, even after the little girl passed away in 1968, aged four.

Speaking to the peer, you sense that he truly cares for his employees.

Asked about how the pandemic affected business, he responded in an unexpected way.

“We are surviving, and we have worker shortages, especially in India,”

“In India, the people have to go away. They come from 100 miles, 200 miles, from villages, with no place to live.

“So, they haven’t worked.

“The factories, what they could sell, they couldn’t produce, and even their customers, for example, the car manufacturers, we make the products for them.

“We can’t supply and even they can't buy because if they buy, they can’t make the cars, and if they make the cars, they don't have that many cars to sell.”

Legacy

For those who have read his memoir, Beyond Boundaries, one sentence resonates throughout the book.

“Compassion, to me,” wrote Paul, “is not simply open-ended charity, cheque-book sympathy, or bleeding-heart liberalism.

“It has a moral content, but it is also a way in which we can hold society together and improve ourselves by doing so.”

That is probably why, pandemic or not, Paul’s interests continue to flourish.

For example, he has invested millions of dollars in the redevelopment of a 14-acre former foundry site in St Louis, Missouri, into retail stores, offices and a food hall.

The site is now called City Foundry STL.

According to an end of year update last month, the developer, New + Found, appears to have resolved challenges caused by Covid.

It expects to begin the second phase of the US$340 million project this month.

In an email seen by Eastern Eye, the CEO of the project, Steve Lawrence wrote, “It has been such a pleasure to work with everyone on the Caparo team.”

Further, this paper has learnt that the City Foundry STL development will also include a theatre, which will be named after the baron.

For someone who starts the second year of his 10th decade, legacy is important.