BARCLAYS posted a jump in half-year profits on lower litigation costs and higher interest rates but the bank warned that the benefits of rising interest rates has begun to fade.

Profit after tax (PAT) grew 26 per cent year-on-year to £3.1 billion in the six months to the end of June, Barclays said in an earnings statement on Thursday (27).

It had reported a PAT of 2.91bn in the corresponding period last year when its earnings were hit by the costs of paperwork errors in the US.

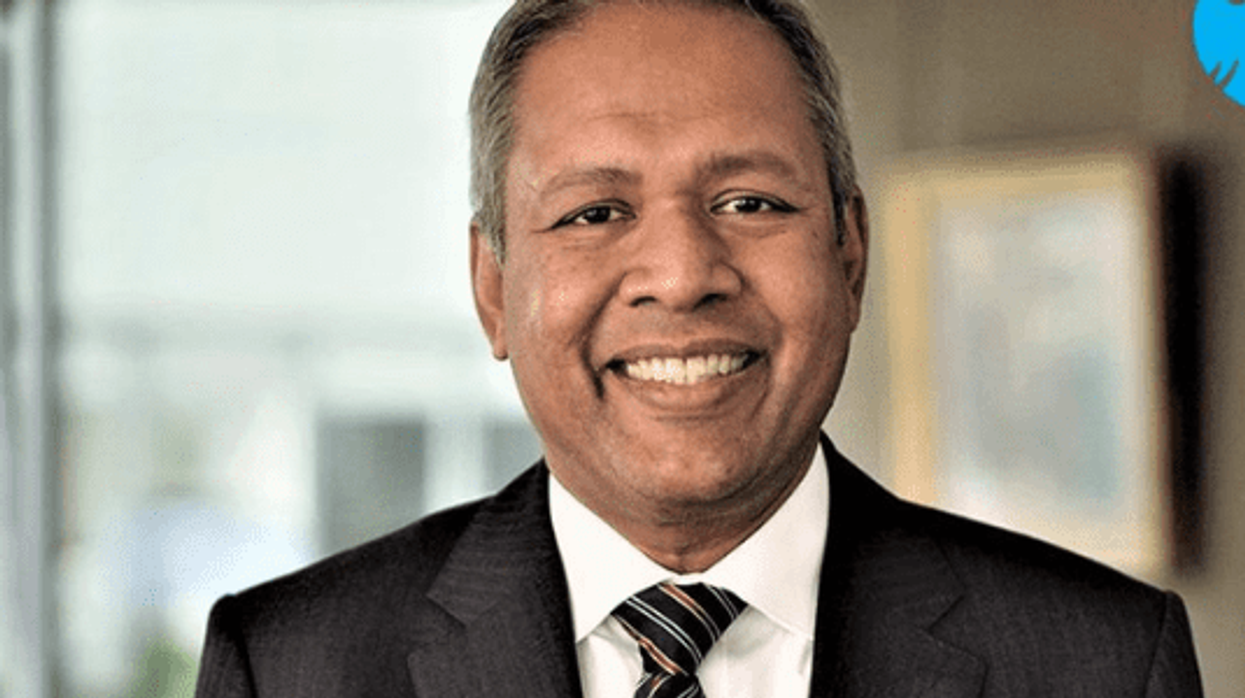

"Through our diverse sources of income, prudent risk management, and ongoing cost discipline we have again demonstrated the stability and strength of the franchise," chief executive CS Venkatakrishnan said.

"This means we are able to distribute increased capital returns to shareholders, while providing targeted support to our customers and clients."

Barclays said it would return £750 million to shareholders by repurchasing stock.

The bank said it had significantly increased the amount of money set aside for potential bad loans, such as soured mortgages after interest rates surged.

Global central banks including the Bank of England have ramped up borrowing costs to tackle elevated inflation.

The increases have prompted retail banks to hike their own interest rates on loans including mortgages, worsening a cost-of-living crisis in Britain.

"The idea that higher interest rates make life easy for banks is a misconception," AJ Bell investment director Russ Mould noted Thursday.

"Yes, there is an opportunity to earn more money from lending. However, higher rates can curb activity for consumers and businesses which means investors are increasingly looking at the levels of bad debts."

Mould added that Barclays faced competition from smaller lenders offering more competitive savings rates in a bid to grow customer numbers.

Barclays' results a year earlier were impacted by heavy litigation costs linked to the bank having sold more products to investors in the United States than allowed.

(With inputs from AFP)

Lower costs, rate hikes drive Barclays’ profit

We are able to distribute increased capital returns to shareholders, says CEO Venkatakrishnan