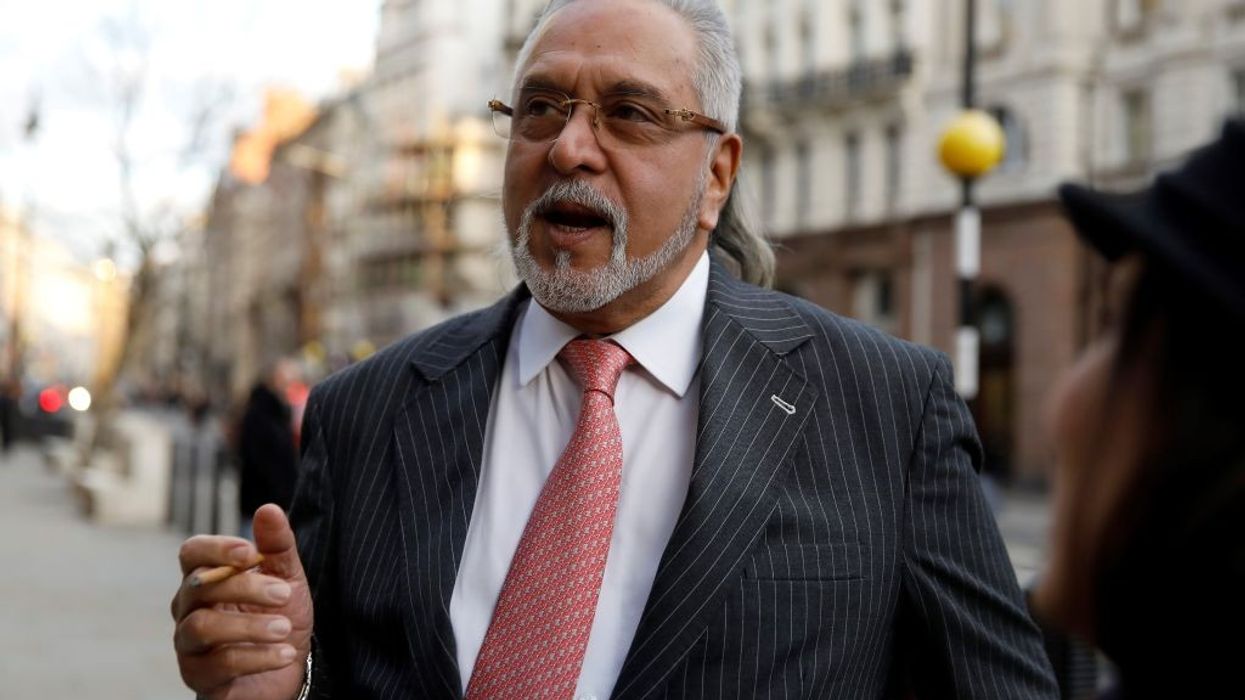

EMBATTLED Indian businessman Vijay Mallya on Tuesday (18) lost a legal battle to hold on to his London home after a UK court refused to grant him a stay of enforcement in a dispute with the Swiss bank UBS.

The 18-19 Cornwall Terrace luxury apartment overlooking Regent's Park in central London is described in court as an "extraordinarily valuable property worth many tens of millions of pounds" and is currently occupied by Mallya's mother Lalitha, 95.

Delivering his judgment virtually for the Chancery Division of the High Court, deputy master Matthew Marsh concluded there were no grounds for him to grant further time for the Mallya family to repay a £20.4-million loan to UBS, the claimant.

"The claimant's position was a reasonable one… Further time is not likely to make any material difference," Marsh ruled.

"I would also add from my review of the correspondence, I can see no basis whatsoever for the suggestion... that the claimant has misled the first defendant (Vijay Mallya)… In conclusion, I dismiss the first defendant's application,” he said.

The judge also declined permission to appeal against his order or to grant a temporary stay of enforcement, which means UBS can proceed with the possession process to realise its unpaid dues.

"I will refuse permission to appeal and therefore it follows that I will not be granting a stay," said Marsh.

Mallya's barrister, Daniel Margolin QC, indicated the 65-year-old businessman plans to pursue an appeal before a High Court Chancery Division judge as it has "serious consequences" for his clients, including Mallya's elderly mother.

Fenner Moeran QC said UBS will proceed with the enforcement order without delay.

The case relates to a mortgage taken out by Rose Capital Ventures, one of Mallya's companies, with the former Kingfisher Airlines boss, his mother and his son Sidhartha Mallya listed as co-defendants with right of occupancy of the property.

In May 2019, judge Simon Barker handed down a consent order allowing the family to retain possession with a final deadline of April 30, 2020, granted for the repayment of the loan. But the deadline was not met.

With special rules in place over the Covid-19 pandemic period, UBS was legally unable to pursue enforcement until April 2021.

When the bank sought a court order for the enforcement in October last year, Mallya filed an application of stay, saying the bank had placed “unreasonable obstacles” in his path to repay the sums through family trust funds.

His legal team also produced a non-binding letter claiming a company was willing to acquire the property, which would help pay off the loan.

However, Marsh concluded that the letter was of “limited assistance” and expressed “real doubts about the bonafide of that offer”.

Under the May 2019 order, UBS was granted an “immediate right to possession” and Mallya and the co-defendants were not permitted to make any further applications to “postpone or suspend the date for giving up possession”.

The court order also forbid any further claims arising out of the bankruptcy proceedings against Mallya by a consortium of Indian banks led by the State Bank of India (SBI).

Mallya is wanted in India to face charges of fraud and money laundering amounting to Rs 9 billion (£980 million) related to loans made to his now-defunct Kingfisher Airlines.