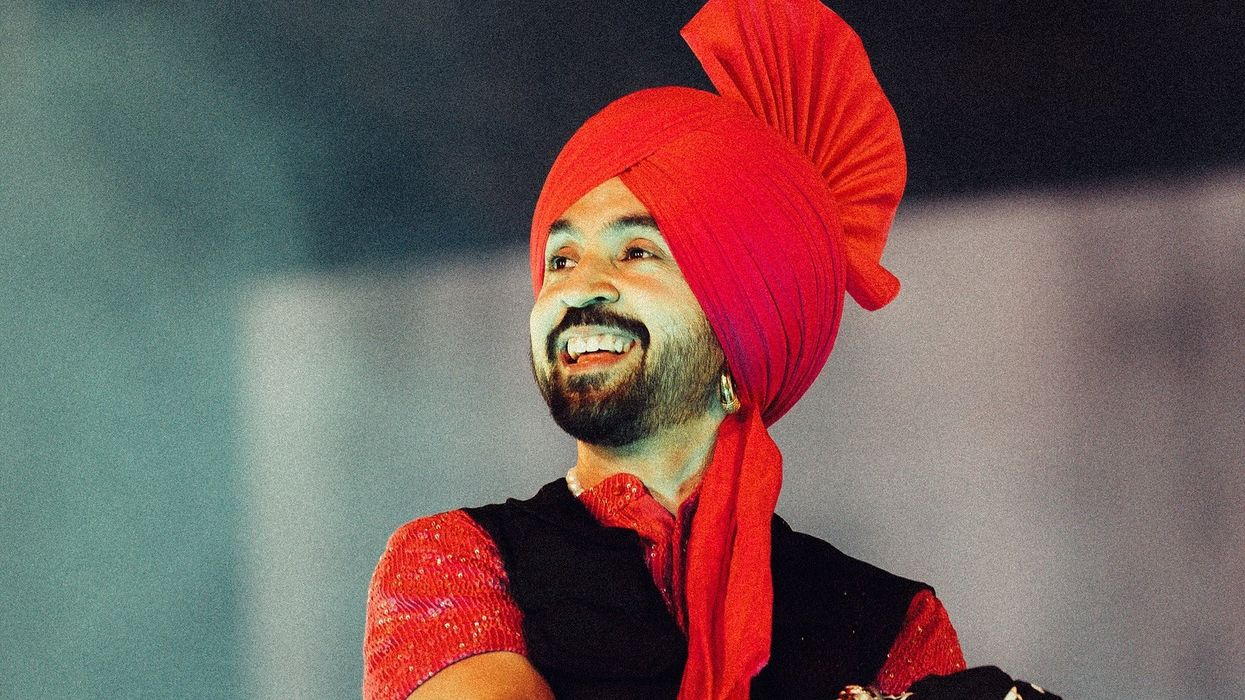

MOHMED ABUBACKER SAMSUDEEN regularly shares top money saving tips and financial advice with more than a million followers on Instagram.

Also known as Time Billionaire, the popular finance content creator and serial entrepreneur covers topics in all areas, which are ultimately designed to help people negotiate the cost of living, every day expenses and unexpected money pitfalls.

Before selecting 10 money saving tips, he said: “With prices on the rise for nearly everything, it’s crucial to be mindful of our spending. Research shows that 84 per cent of shoppers make impulse purchases driven by emotional and psychological factors. Here are my top 10 money saving tips that I prioritise in my daily life, and highly recommend”.

Travel hacks: As a frequent traveller, here are a few tips that help me save on my expenses. Use incognito mode when searching for plane tickets to avoid price hikes based on your search history. Fly on Tuesdays, Wednesdays or Saturdays for lower prices, as these days are less popular than Fridays and Sundays. Always compare prices between travel agencies and online sites, as travel agencies often secure better deals due to wholesale rates. Travel during the off-season or on weekdays to save on accommodations and food, and to avoid crowds. Research your destination and use local transportation. Locals can offer helpful advice. Also, don’t keep all your money in one place – distribute it within your luggage, perhaps in your clothes.

Grocery: I have always been told that going grocery shopping if you are hungry ends up in you buying unnecessary items. So, shop after a meal to avoid impulse buys. Plan your meals, make a shopping list, and stick to it. Buy in bulk for non-perishable items and use coupons and cashback apps to maximise savings.

Shopping: Use cashback sites and regularly check debit card reward points. Shop during sales, use discount codes and consider secondhand items. Delay non essential purchases to avoid impulse buys and find the best deals.

Electricity bill: Reduce your electricity bills by being more aware of your usage. Turn off fans and lights when leaving a room, use energy-efficient bulbs and appliances, and turn off the air conditioner once the room is cool enough. Lowering your water heater temperature can also help. And always use AC at 25 degrees Celsius to save electricity.

Buying a car: If you want to buy a car, do it at the end of the month when salespeople are trying to meet their quotas. They’re more likely to offer you a deal.

Apply the 30-day rule: Refrain from purchasing any non-essential items, such as sneakers or smartphones, right away. Instead, bookmark or monitor the product and wait for 30 days. If, after this period, you still strongly desire the item, you can proceed with the purchase, but only using cash. This approach encourages you to prioritise buying only what you truly need.

Be debt free: Using your credit card frequently and not paying bills on time can pile up and make you go into debt. To avoid these debts, you should use cash frequently and leave your credit card at home, as it’ll decrease your chances of spending more. If you must use a credit card, then make sure to pay the bills on time.

Create an extra income: A side hustle is simply another activity that you do on top of your main job that earns a bit of income. It should ideally fit comfortably into your daily life. For example, when freelancing, identify your niche expertise (like content writing, video editing, business consulting, coaching) and master the art of marketing your services, along with competitive pricing. If you want to become a content creator, use platforms like YouTube, Instagram, or a blog to share valuable content. Engage your audience to grow a following, and then monetise through ads, sponsorships, or selling products.

Mutual funds: Invest a certain amount in various mutual funds. Once invested, let the money accumulate for a few years. A systematic investment plan helps balance risk by spreading your investment through periodic intervals and maximising returns from the market. If the market crashes, consider investing more since units are often cheaper, which can be beneficial in the long term.

The 50/30/20 rule: This is a budgeting guideline that I now follow strictly. It helps me be mindful of my spending and saving habits by allocating my income as follows: 50 per cent for needs – this portion covers essential expenses like housing, utilities, groceries, and transportation; 30 per cent for wants – allocate this for non-essential expenses such as dining out, entertainment, and hobbies; and the remaining 20 per cent goes towards savings, investments, and paying off debts.

Instagram: @timebillionaireab