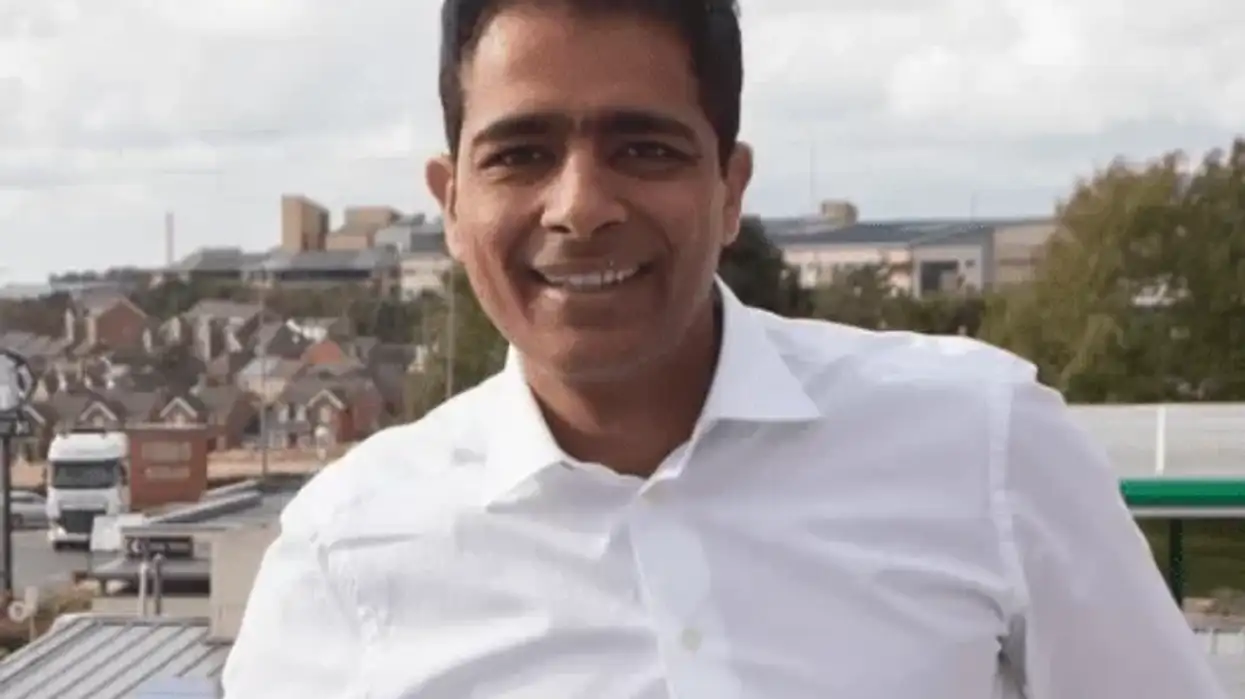

A COMMONS panel has asked Asda co-owner Mohsin Issa to appear before it on July 19 over the retailer’s fuel pricing.

The Business and Trade Select Committee's request for the interview comes after the Competition and Markets Authority (CMA) said retailers including Asda were less aggressive in pricing, which resulted in motorists paying 6p extra per litre of fuel on average.

According to the antitrust watchdog, the pricing policies of the UK’s top four retailers cost an additional £900 million for customers in 2022 alone.

Its report said: “The historic price leaders in the retail market, primarily Asda but also Morrisons to some extent, have been taking a less aggressive approach to pricing by significantly increasing their internal margin targets for fuel over recent years, with the largest increase coming in 2022-23.”

In 2022, Asda decided to achieve "higher margins" by reducing prices in some of its petrol filling stations "more slowly than would previously have been the case as wholesale prices fell, with other retailers pricing by reference to them following a similar pricing path,” the CMA said.

“The potential profitability of any move by a retailer to increase their margins will depend on the response of their competitors,” it said adding, “In this case, other retailers, including the two other supermarket fuel retailers, Sainsbury’s and Tesco, have maintained largely passive pricing policies.”

However, the competition watchdog acknowledged the presence of Asda resulted in lower prices.

Lower prices in an area were “typically associated with having a supermarket competitor, and particularly an Asda competitor”, though the effect had weakened since the beginning of the last year, it said.

Issa, who along with his brother Zuber and the private equity firm TDR Capital bought Asda in 2021 for an enterprise value of £6.8 billion, said, “We have engaged fulsomely and openly with the Business and Trade Select Committee on grocery and fuel price inflation.”

“We are disappointed to hear that the committee feels there are discrepancies in our evidence and have provided them with a detailed response to their letter requesting a further interview”, he said.

Asda said in a statement that the company “carefully managed” its business to ensure it was the “cheapest traditional supermarket” for both groceries and fuel “despite record inflation”.

However, the retailer has not confirmed whether Issa will attend the interview with the parliamentary panel.

Mohsin Issa asked to appear before Commons panel over Asda’s fuel pricing

A Competition and Markets Authority report says the pricing policies of the UK's top retailers cost an additional £900m for customers in 2022 alone