THE cost of living crisis is leading to more British Asians from poorer backgrounds being unable to own a home and living with their parents for longer, say experts.

They have also noted many from middle class backgrounds are staying in the family home after marriage to look after their parents and get help with childcare.

Record numbers of adults in the UK aged under 35 live with their parents, according to official data, 100,000 more than before the pandemic.

Last year, some 3.58 million adults aged between 20-35 lived with their parents, 1.1 million more than 20 years ago. Of these, some 61 per cent were men.

Rohini Kahrs, communications manager for The Runnymede Trust race equality thinktank, told Eastern Eye: “As the cost of living crisis deepens, we are seeing more and more people unable to afford to rent a property.

“We know that for every £1 of white British wealth, Pakistani households have around 50p, and Bangladeshi households have approximately 10p. So depending on which south Asian groups we are discussing, for many this is an issue primarily of economics and earnings.

“If we could track the trajectory of those living with their parents in terms of class, we are likely to see that middle-class Bangladeshi and Pakistani people may have moved out of their family homes because they can afford to.”

It comes after figures in April showed that house prices in Britain are at their highest ever levels having risen on average by more than a fifth since the pandemic in 2020. Kahrs added that specific to many south Asian groups is the additional burden of care which comes with living in multi-generational households.

She said: “Many elderly Pakistani and Bangladeshi people may not have savings or pensions, due to working in underpaid and precarious jobs for most of their working life.

“Younger generations may therefore be stepping in to weather the dramatic effect this cost of living storm is having.

“Hikes in energy, fuel, and food prices is leaving millions in poverty and in debt, debts which most people have no means to cover.”

Research in May from property concierge platform Moveable found that 36 per cent of Britons aged 25-34 are waiting to get married or find a partner before buying their first home due to the costs.

This number rises to 40 per cent for those aged 18-24.

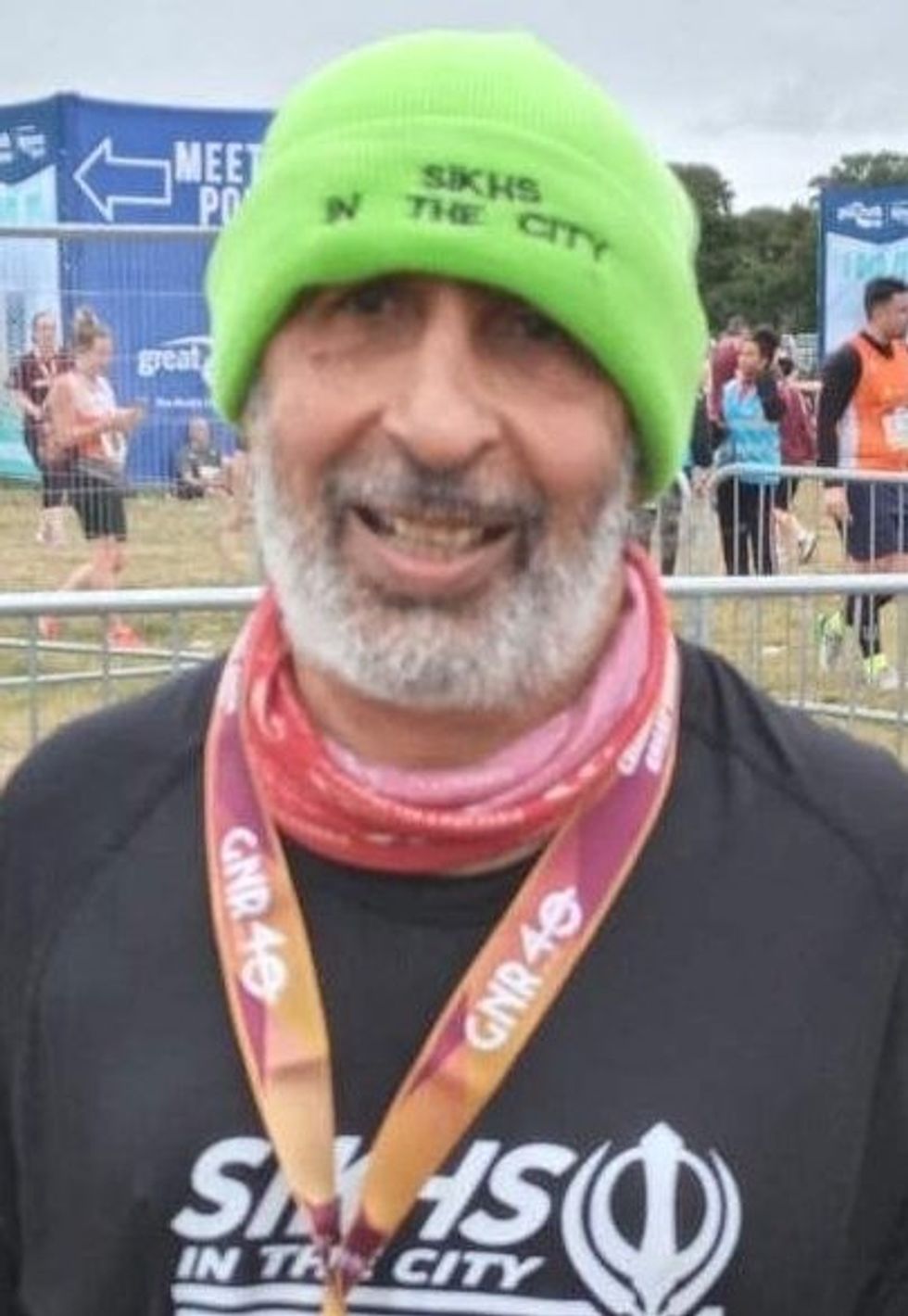

Harmander Singh, a social policy expert in East London, said there are many cultural reasons why more people from the south Asian community choose to remain living in the family home.

He told Eastern Eye: “The reason why they may be living at home is catering to their parents who hope their children look after them when they are old, the extended family ethos. They also may inherit the house.

“Asian families often put their resources together and buy a property to rent it out as an investment after the parents have paid off the mortgage.

“My son Jas was here until the age of 35 with his wife and two kids. It was tradition, what is eroding it is Western culture and being materialistic and wanting their own independence – sometimes children who leave home early end up being subsidised by their parents if they don’t make it in business for example.”

The average age of a first-time house buyer is 32, according to UK Finance, up from 30 a decade ago. And the average monthly rent is about £969 a month, according to property website Zoopla, an 8.3 per cent increase since March 2020.

Shehnaz Khan, 31, moved back to her parents’ home in London temporarily after giving birth in 2020.

She told this newspaper: “My mum offered all kinds of support with the baby who was born slightly earlier and my husband and I really couldn’t have managed without the help.

“My sister has just given birth and lives with her in-laws, she really appreciates the help.

“It’s difficult being a first time parent and it’s reassuring when you are around experienced people.

“My neighbour got married last year and has continued to live with his parents. It’s more affordable and his wife is pregnant so I’m sure they can do with all the help. Growing up I lived in a joint family and it was more common then to all live together, now I think people are returning to this because financially it’s more manageable.”

Shreya Nanda, 27, who leads housing affordability research at the Institute for Public Policy Research, said she lives with her parents in London because it is too expensive to move out.

She said: “New Nationwide figures show that homeowners saw average house price gains of 12.1 per cent in April. This is likely linked to monetary policy loosening earlier in the pandemic.

“Meanwhile, renters saw their rents go up by 8.7 per cent.

“The distributional effects of monetary policy – more important than you might think!”

Boris Johnson is considering launching his own right-to-buy homes scheme, according to reports in May.

The plan would allow tenants in housing association properties to buy their homes with their benefit payments used to help secure mortgages.

This could likely affect around 2.5 million households in England who rent properties from associations and give them the chance to purchase them at a discounted price.

Currently, Right to Buy lets most council tenants buy their homes at a discount but tenants can only buy a property acquired by an association since 1997.

Simon Bath, CEO of property technology company iPlace Global, said: “With the cost-of-living crisis severely impacting the ability for Brits to get onto the property ladder, the prime minister’s announcement could potentially act as a stepping stone for many – particularly for the younger generation.

“While it’s a step in the right direction to assist the new generation with property ownership, we must ensure that more social housing is also being built, so that there are still options for those who may not be able to buy a home and who need it most.

“The government must take their time to introduce new measures when developing this scheme to ensure that the property market can cope with these changes; and more importantly, to make sure that every person in the country has the equal opportunity to own a home.