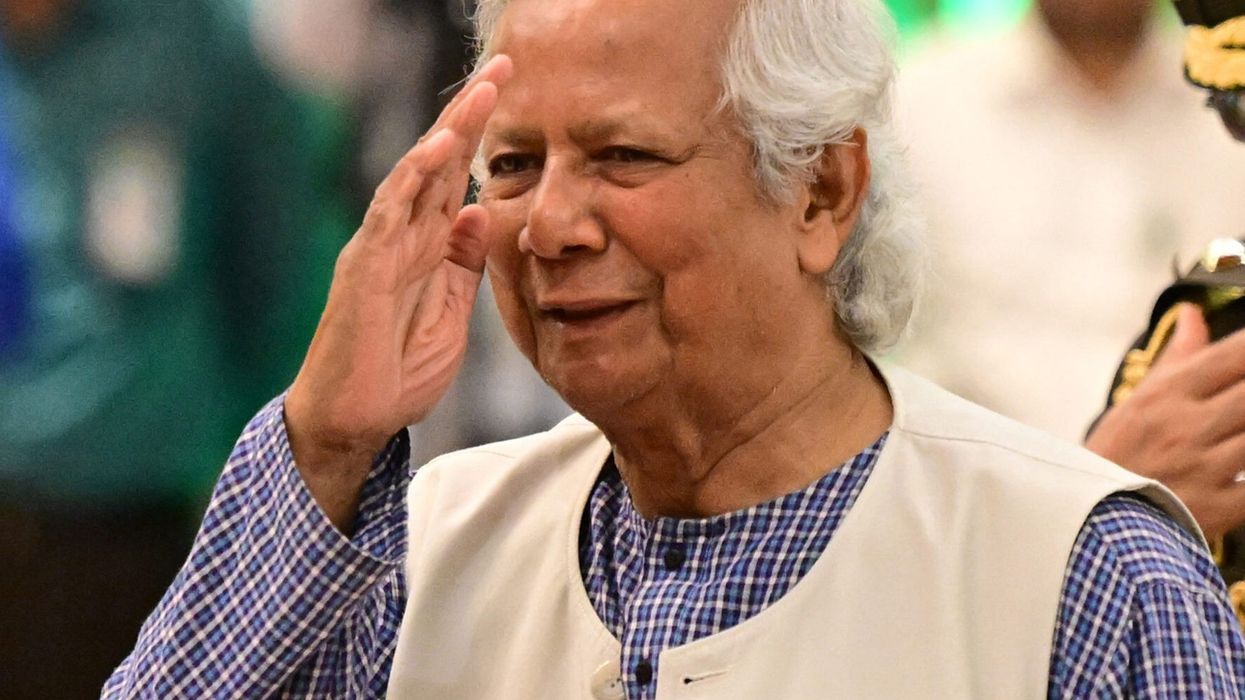

NOBEL laureate Muhammad Yunus, known for his pioneering work in microfinance, has taken charge of Bangladesh's newly formed interim government following the resignation and exile of prime minister Sheikh Hasina.

Yunus, 84, was sworn in after a period of intense student-led protests and deadly unrest that culminated in the end of Hasina's 15-year tenure. Upon taking office, Yunus emphasised the need to restore law and order and return the country to democratic governance.

Yunus, often referred to as the "banker to the poor," was awarded the Nobel Peace Prize in 2006 for his work through Grameen Bank, which he founded to provide small loans to rural women. This microfinance model has been credited with boosting economic growth in Bangladesh and has been replicated in several developing countries.

Despite his international acclaim, Yunus faced significant opposition from Hasina, who accused him of exploiting the poor. His rising popularity and initial foray into politics in 2007, when he announced plans to form a "Citizen Power" party, further strained relations with Hasina's government.

Yunus's political ambitions were short-lived, but the tensions with the ruling elite persisted. Over the years, he faced over 100 criminal cases and a state-led campaign that accused him of various wrongdoings, including promoting homosexuality. In 2011, Yunus was forcibly removed from his position at Grameen Bank, a decision upheld by Bangladesh's top court. More recently, in January, he and three colleagues were sentenced to six months in prison by a Dhaka labour court for failing to establish a workers' welfare fund. They were, however, released on bail pending an appeal, and Yunus was acquitted by a Dhaka court on Wednesday.

Yunus's appointment as the head of the interim government was endorsed by student leaders who had been at the forefront of the protests against Hasina. After meeting with the military and president Mohammed Shahabuddin, it was decided that Yunus would lead the country until new elections could be held. Upon his return to Bangladesh, Yunus called for calm and urged citizens to prepare for free elections within months.

Born in 1940 in Chittagong, Yunus grew up in a well-to-do family, with his father working as a successful goldsmith. His mother, who frequently helped those in need, greatly influenced Yunus's commitment to social causes. After winning a Fulbright scholarship, Yunus studied in the United States before returning to Bangladesh, which had just gained independence from Pakistan in 1971. He was appointed head of the economics department at Chittagong University but soon found himself drawn to addressing the severe poverty and famine affecting the country.

In 1983, Yunus founded Grameen Bank, driven by his belief that poverty was a threat to society and that financial inclusion was key to alleviating it. Grameen Bank, which now serves over nine million clients, with more than 97 per cent being women, has played a significant role in lifting millions out of poverty. Yunus's work has earned him numerous honours, including the US Presidential Medal of Freedom.

As he takes on the role of chief adviser in the interim government, Yunus faces the daunting task of steering Bangladesh through a period of economic challenges and political instability. His economic philosophy emphasises "social businesses" that prioritise solving societal problems over profit generation. This approach has been integral to Grameen Bank's success and is likely to influence his leadership of the interim government.

Yunus has also been a vocal advocate for women's empowerment, a principle reflected in Grameen Bank's operations, where women make up the majority of borrowers. His commitment to this cause has been recognised globally, with Yunus participating in various international commissions focused on women's issues.

Despite his success, Yunus's critics, including those in Bangladesh and neighbouring India, have accused him of charging excessive interest rates on microloans, a claim he disputes by arguing that his rates are lower than those of local moneylenders. Yunus's relationship with Hasina's government has been particularly fraught, with the prime minister accusing him of undermining her administration.

As he leads Bangladesh's interim government, Yunus will need to navigate the complex political landscape while addressing the country's pressing economic issues. He has called for multinational social businesses that benefit the poor and has warned of the dangers of poverty, describing it as a threat to peace and stability. His vision for Bangladesh includes greater integration with global markets and a focus on uplifting the country's most vulnerable populations.

Yunus is expected to serve as chief adviser until new elections are held, marking a critical juncture in Bangladesh's political history. His leadership will be closely watched, both at home and abroad, as the country seeks to stabilise and chart a path forward.

(With inputs from agencies)