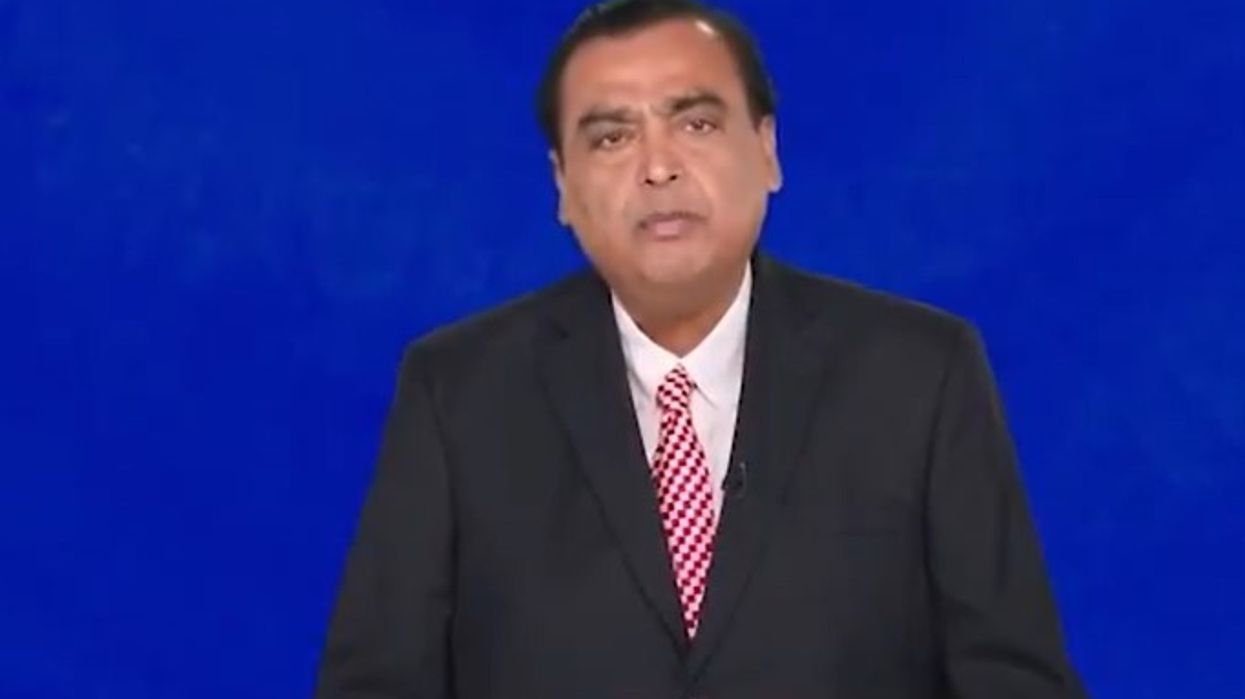

BILLIONAIRE Mukesh Ambani on Thursday outlined the next phase of growth for Reliance Industries Ltd, focusing on expanding its retail and telecom sectors to exceed £76.3 billion each, doubling revenues and pre-tax profits within 3-4 years.

The company’s new energy business is expected to become profitable by 2031, while the core oil and chemicals segment will remain a key driver of growth.

Reliance Industries, which has interests in refining, oil and gas, petrochemicals, telecoms, retail, and media, is projected to more than double in size by the end of the decade, Ambani, the chairman and managing director, informed shareholders.

The company plans to enhance AI adoption, including the launch of 'Jio Brain'—a suite of AI tools and platforms—and will establish gigawatt-scale AI-ready data centres in Jamnagar, Gujarat. These efforts aim to create the world's lowest AI inferencing cost, making AI applications more affordable in India.

Ambani also announced that Jio users will receive up to 100 GB of free cloud storage, a move expected to impact the market significantly. Since its launch in 2016, Jio has grown to become India's largest telecom company and the world's leading data firm, driven by affordable data and free voice calling. The introduction of free cloud storage may lead to similar industry disruption.

"We have built each of our businesses from scratch and grown them to a global scale. We did not receive them as largesse," Ambani stated, emphasising that Reliance is focused on creating wealth and ensuring energy security, rather than short-term profits.

In 2017, Ambani promised that Reliance would join the ranks of the world's Top 50 corporations before its Golden Jubilee. He confirmed that Reliance is now among the Top 50 most valuable companies globally. In July 2018, Reliance crossed the £76.3 billion valuation mark and has since become the first Indian company to surpass £190.7 billion in market value.

"In 2022, I promised that Reliance would double its value by the time we complete 50 Glorious Years in 2027," Ambani said, noting that the group is on track to more than double in size before the end of the decade and expects to grow even faster in the years ahead.

Three of Reliance's five key growth sectors—oil-to-chemical (O2C), retail, and telecom—are valued at over £76.3 billion each and are projected to continue expanding rapidly. Ambani predicted that Jio and Retail would double their revenues and EBITDA in the next 3-4 years. He also described the new energy business as a future "jewel in Reliance's crown," expected to become as significant and profitable as the O2C business over the next 5-7 years.

Ambani highlighted that green fuels and AI-based solutions will serve as long-term growth drivers for Reliance. The company's media businesses, which are merging with Disney India, also hold substantial growth potential.

Before the annual general meeting, Reliance announced that its board would consider issuing bonus shares in a 1:1 ratio on September 5. This will be the first bonus share issue since 2017 and the third since 2009. Ambani described the bonus issue as a reward for shareholders who have been part of Reliance's growth journey.

Ambani did not provide timelines for a potential demerger and listing of the retail and Jio businesses, although these are considered key indicators of growth. Last year, he brought his three children—Akash, Isha, and Anant—onto Reliance's board as part of succession planning. On Thursday, he stated that they have taken on greater responsibilities, with Akash overseeing the telecom venture, Isha managing retail, and Anant focusing on the new energy business.

Reliance's retail business, with approximately 19,000 stores across 7,000+ cities and an e-commerce platform, is among the top 10 global retailers by market cap and among the top 30 by revenues. The telecom arm, Jio, serves 490 million users and handles 8 per cent of global mobile traffic. Jio has also completed its 5G rollout and is targeting 100 million homes for its JioAirfiber broadband service, while building large-scale AI infrastructure.

In the O2C sector, Reliance is expanding capacities in PVC and polyester production and constructing India's first carbon fibre plant at Hazira, Gujarat. In the new energy sector, the company is on track to invest the committed £435.4 million to establish a new energy ecosystem. Solar photovoltaic (PV) module production is set to begin by the end of the year, with plans to achieve the first phase of integrated solar production facilities in the following quarters. This will include modules, cells, glass, wafers, ingot, and polysilicon, with an initial annual capacity of 10 GW.

Reliance is also constructing an advanced chemistry-based battery manufacturing facility with a 30 GWh annual capacity at Jamnagar, set to begin production in the second half of next year. Additionally, the company is developing a fully automated, multi-GW electrolyser manufacturing facility on India's west coast, expected to be operational by 2026.

Ambani stated that Reliance has leased arid wasteland in Kutch, approximately 250 kilometres from Jamnagar. This land has the potential to generate about 150 billion units of electricity over the next 10 years, providing nearly 10 per cent of India's energy needs. The company has begun significant project development work and is constructing the necessary transmission infrastructure for solar generation projects.

Reliance has also secured nearly 2,000 acres of land at Kandla port to support the production, storage, evacuation, and shipping of green fuels to both domestic and international markets.

(With inputs from PTI)