PAKISTAN'S parliament has given the go-ahead for the government to raise taxes on a raft of luxury imports and services in a bid to unlock the next tranche of an International Monetary Fund (IMF) loan.

Faced with critically low foreign exchange reserves, the government has already halted most imports - apart from food and pharmaceuticals - but hopes to boost revenue with the broad tax hike.

Years of financial mismanagement and political instability have pushed Pakistan's economy to the brink of collapse, exacerbated by a global energy crisis and devastating floods that submerged a third of the country in 2022.

However, with an election due by the end of the year, the government is reluctant to be too harsh in case it is punished at the polls.

Parliament approved on Monday (20) a supplementary finance bill that increases sales tax from 17 to 25 per cent on imports ranging from cars and household appliances to chocolates and cosmetics.

People will also have to pay more for business-class air travel, wedding halls, mobile phones, and sunglasses.

A general sales tax was raised from 17 to 18 per cent.

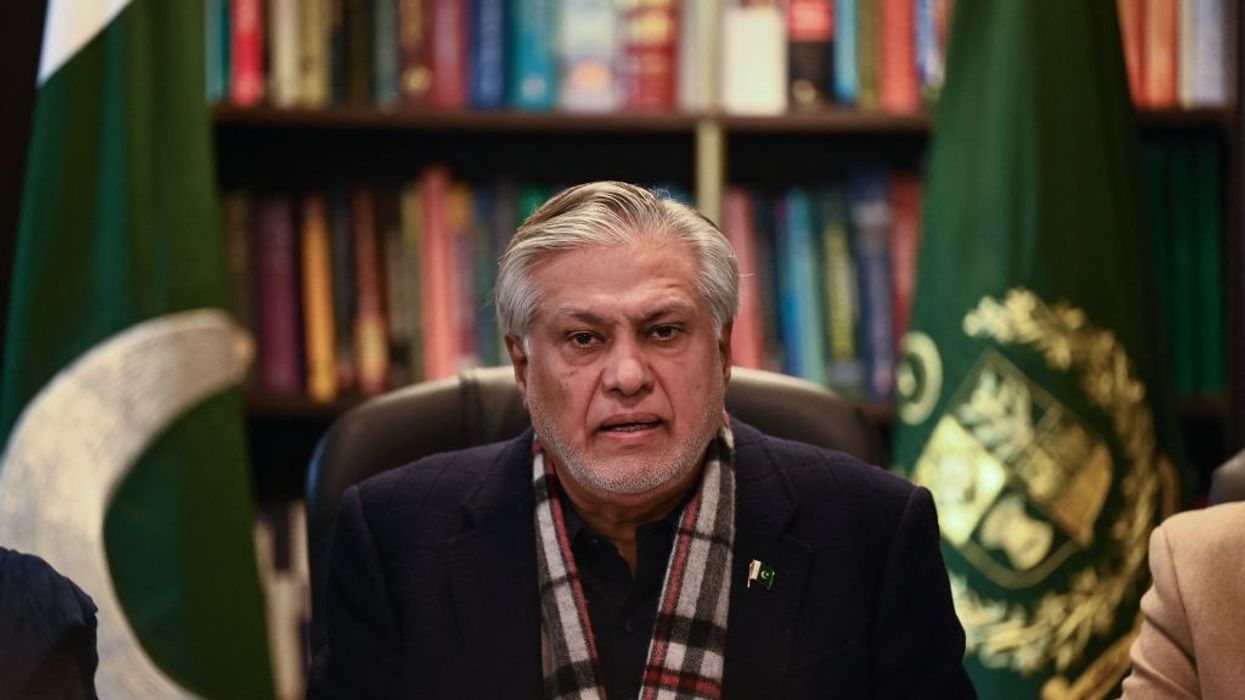

"The prime minister will also unveil (further) austerity measures in the next few days," finance minister Ishaq Dar told the National Assembly as the bill was passed, adding "we will have to take difficult decisions".

Pakistan is desperate to unlock the next tranche of a $6.5 billion loan facility with the IMF but struggling to meet tough conditions set by the global financier.

The IMF is demanding that Pakistan boosts its pitifully low tax base, ends exemptions for the export sector, and raises artificially low energy prices that are meant to help poor families.

"Those who are making good money in public or private sectors need to contribute to the economy," IMF Managing Director Kristalina Georgieva told German state broadcaster Deutsche Welle at the weekend.

"It shouldn't be that the wealthy benefit from subsidies. It should be the poor who benefit from them."

Dar told parliament when tabling the bill this month that the luxury tax would generate an additional $650 million.

"These are the items which are widely used by the rich class," he said, adding it would "put minimum burden on the common man".

While an IMF cash injection will not be enough to rescue Pakistan on its own, it is necessary to boost confidence and open the doors for friendly nations such as Saudi Arabia, China and the United Arab Emirates to offer further loans.

(AFP)

Pakistan hikes tax on luxury goods and services to get IMF deal