PAKISTAN is expected to get an investment of $5 billion (£3.9bn) over the next three years from local and international firms for the exploration and development of petroleum and gas reserves.

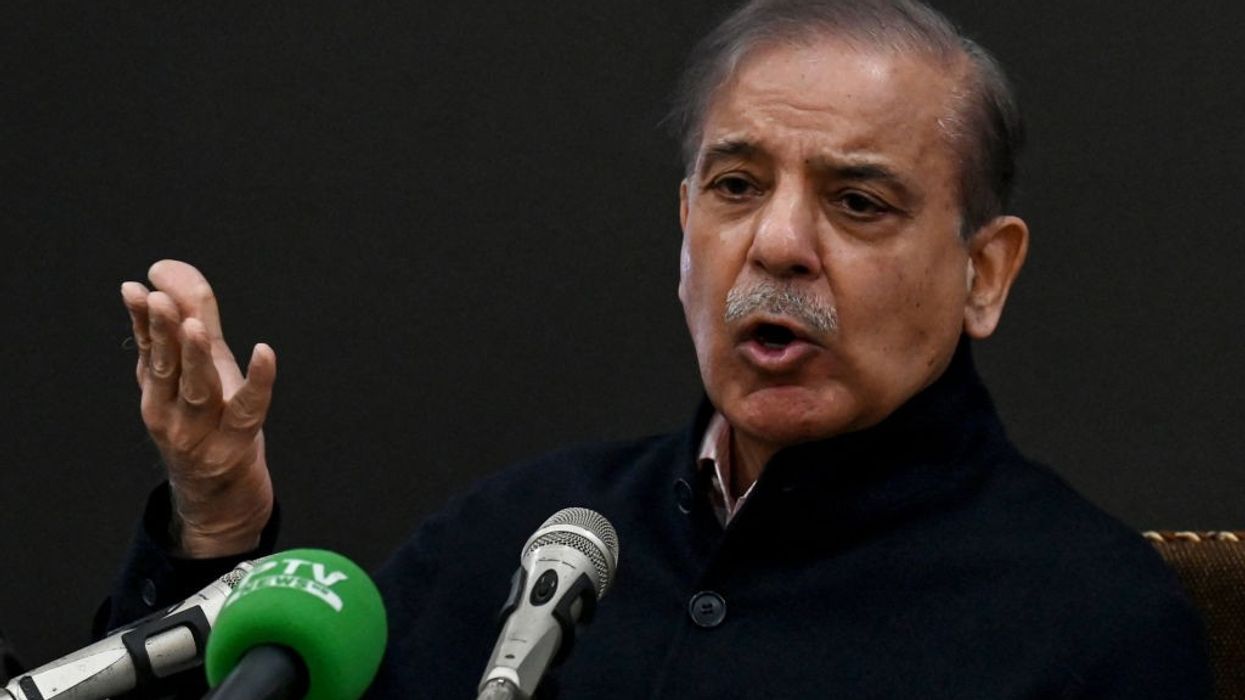

The announcement was made in a meeting presided over by Prime Minister Shehbaz Sharif on Saturday during a meeting with a delegation of oil and gas exploration and production sector companies.

According to the state-run Associated Press of Pakistan, the meeting was informed that during three years, around 240 places would be excavated with an investment of $5 billion to explore petroleum and gas in Pakistan.

The meeting was informed that currently, Pakistan's domestic production stood at 70,998 barrels and 3,131 MMSCFD (million standard cubic feet) gas per day.

The prime minister invited petroleum and gas exploration and production companies to also find offshore reserves.

“Exploring the oil and gas reserves at the local level in Pakistan is our top priority,” Prime Minister Sharif said, adding that Pakistan spent billions of dollars every year on importing oil and gas.

Currently, the price of petrol in Pakistan is Rs 265 (£0.74) a litre and high-speed diesel is Rs 277 (£0.78) a litre.

The oil exploration will help save the cash-strapped country's valuable foreign exchange and relieve the common man from high fuel prices. (PTI)