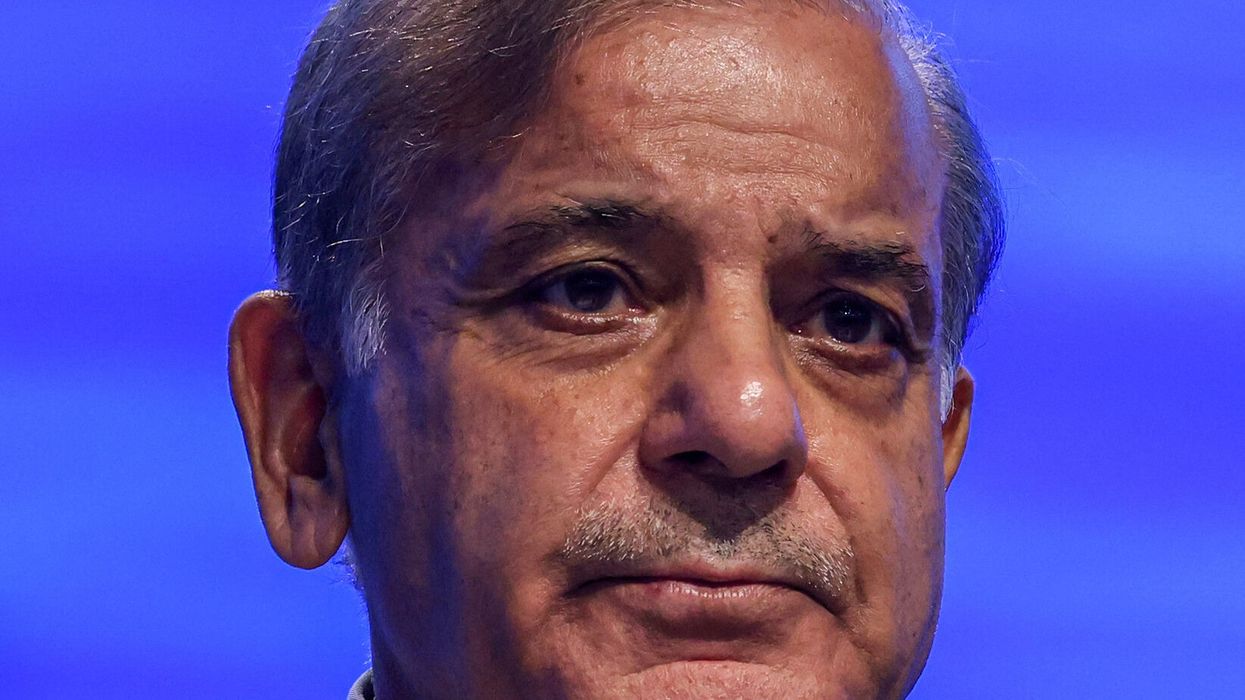

PAKISTAN will privatise all state-owned enterprises, with the exception of strategic entities, prime minister Shehbaz Sharif said on Tuesday (14), broadening its initial plans to sell only lossmaking state firms to shore up its shaky finances.

The announcement came after Sharif headed a review meeting of the privatisation process of lossmaking state enterprises (SOEs), according to a statement from his office, which discussed a roadmap for privatisation from 2024 to 2029.

“All of the state-owned enterprises will be privatised whether they are in profit or in losses,” Sharif said, adding that offloading the companies would save taxpayers’ money.

The statement didn’t clarify which sectors would be deemed strategic and non-strategic.

The announcement came a day after an International Monetary Fund mission opened talks in Islamabad for a new long-term Extended Fund Facility, following Pakistan’s completion of a $3 billion (£2.38bn) standby arrangement last month, which averted a sovereign debt default last summer.

Privatisation of loss-making SOEs has long been on the IMF’s list of recommendations for Pakistan, which is struggling with a high fiscal shortfall and a huge external financing gap. Foreign exchange reserves are hardly enough to meet a couple of months of controlled imports.

The IMF says SOEs in Pakistan hold sizeable assets in comparison with most Middle East countries, at 44 per cent of GDP in 2019, yet their share of employment in the economy is relatively low. It estimates almost half of the SOEs operated at a loss in 2019.

Past privatisation drives were patchy, mainly due to a lack of political will, market watchers said.

Any organisation that is involved in purely commercial work can’t be strategic by its very nature, which means there can’t be any strategic commercial SOEs, former privatisation minister Fawad Hasan Fawad told Reuters on Tuesday.

“To me, there are really no strategic SOEs,” he said.

“The sooner we get rid of them the better. But this isn’t the first time we have heard a PM say this and this may not be the last till these words are translated into a strategic action plan and implemented,” Fawad added.

Islamabad has for years been pumping billions of dollars into cash-bleeding SOEs to keep them afloat, including one of the largest loss-making enterprises Pakistan International Airline (PIA), which is in its final phase of being sold off, with a deadline later this week to seek expressions of interest from potential buyers.

Pakistan has listed 25 entities and assets on its privatisation list, including the PIA. A majority of the entities are in the power sector, including four power plants, two of which are over 1,200MWs, as well as 10 generation and distribution companies.

The list also includes overseas assets, such as the valuable Roosevelt hotel in New York’s Manhattan and two insurance companies.

The pre-qualification process for PIA’s selloff will be completed by end-May, the privatisation ministry told Tuesday’s meeting, adding discussions were underway to sell the airline-owned Roosevelt Hotel in New York.

It said a government-to-government transaction on First Women Bank Ltd was being discussed with the United Arab Emirates, and added that power distribution companies had also been included in the privatisation plan for 2024-2029. (Reuters)