ANY day now Rachel Reeves will be sending a “cease and desist” letter to Liz Truss, demanding that the former prime minister stop saying she has “crashed the economy”.

Such “false and defamatory” allegations were harming her political reputation, the chancellor will probably add.

A bit late in the day, however, there is a mea culpa from Reeves.

Speaking at the World Economic Forum in Davos, the chancellor indicated she might make concessions to nondoms, now that thousands have already fled the UK – this will be no surprise to Eastern Eye readers.

“We have been listening to the concerns that have been raised by the nondom community,” Reeves told the Wall Street Journal’s Emma Tucker, when asked about the nondom exodus.

“In the finance bill, we will be tabling an amendment which makes more generous the temporary repatriation facility, which enables nondoms to bring money into the UK without paying significant taxes.

“There has been some concerns from countries that have double taxation conventions with the UK, including India, that they would be drawn into paying inheritance tax [IHT]. That’s not the case.

We are not going to be changing those double taxation conventions.”

The damage has already been done, though. A lead story in the Times said: “A record number of millionaires have left Britain since Sir Keir Starmer came to power, and there is growing concern that Labour’s tax plans are exiling international investors and damaging the economy.

“In total, Britain lost a net 10,800 millionaires to migration last year, a 157 per cent increase on 2023, meaning that it lost more wealthy residents than any other country except China. The actual number that moved out is even higher because the net figure also takes into account the millionaires who arrived in the UK.

“The outflow, mainly to other European countries such as Italy and Switzerland, as well as the United Arab Emirates, was especially large among the UK’s richest residents. Some 78 centimillionaires and 12 billionaires left the country last year.

“The figures were compiled by New World Wealth, the global analytics firm, and investment migration advisors Henley & Partners, which looked at high net worth individuals with liquid assets of more than $1 million (£821,500). They show the exodus accelerated after the general election was called. Since that moment, one dollar millionaire has left Britain every 45 minutes.

“A survey of more than 700 nondoms or their tax advisers by Oxford Economics found that nearly twothirds are planning to leave the UK or considering doing so because of the changes. Most said that the principal motivation was the introduction of IHT on their worldwide assets, while many other jurisdictions do not levy the tax at all or have more generous reliefs.”

Just as much damage has been caused by Reeves’s 20 per cent VAT raid on private schools. If schools are forced to close, as is happening, ruining the lives of thousands of children, the money earned by the Treasury apparently to recruit more teachers for the state sector, will be a big zero.

The Independent Schools Council (ISC) has launched legal action against the government over claims that its VAT policy is discriminatory, including against children with special educational needs and disabilities. It has instructed leading barrister Lord Pannick KC, to fight its case. The ISC is hoping for a judicial review of the policy on the grounds that it breaches articles of the European Convention on Human Rights.

A resident in Odessa, Ukraine, as smoke rises from a fire following a strike earlier this month amid the Russian invasion

A resident in Odessa, Ukraine, as smoke rises from a fire following a strike earlier this month amid the Russian invasion

Shweta Warrier

Shweta Warrier Harbans Singh Jandu

Harbans Singh Jandu Aamir Khan

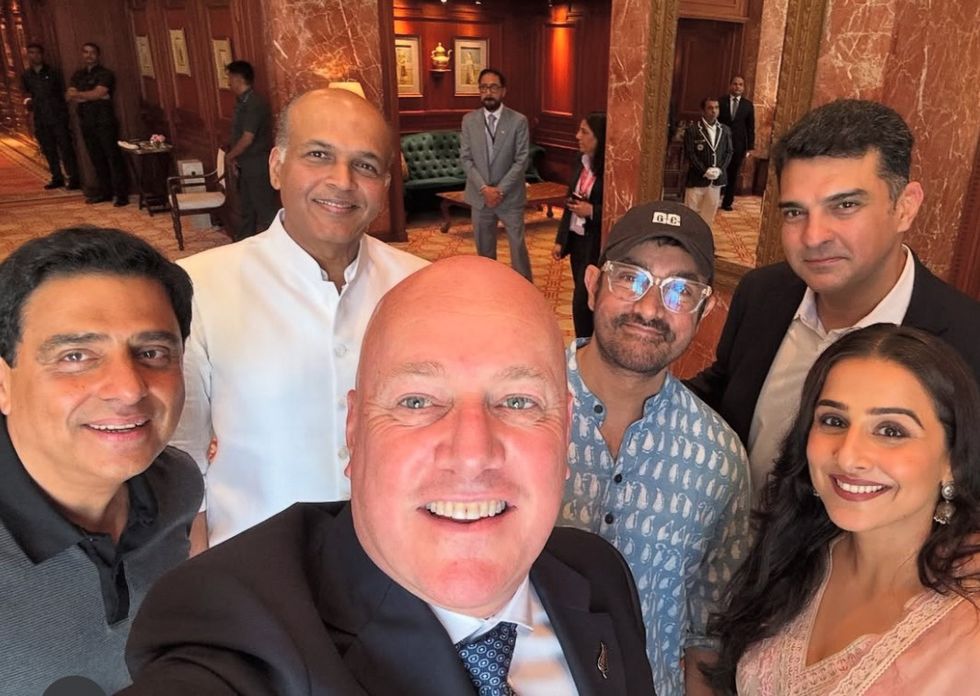

Aamir Khan Ronnie Screwvala, Ashutosh Gowariker, Christopher Luxon, Aamir Khan, Siddharth Roy Kapur and Vidya Balan

Ronnie Screwvala, Ashutosh Gowariker, Christopher Luxon, Aamir Khan, Siddharth Roy Kapur and Vidya Balan Madhuri Dixit

Madhuri Dixit

Manjeet Singh Riyat

Manjeet Singh Riyat