INDIA'S central bank has announced a $24-billion windfall for the cash-strapped government, giving a much-needed boost to prime minister Narendra Modi as he seeks to kickstart growth in Asia's third-biggest economy.

But the payout will likely stoke fresh concerns about the Reserve Bank of India's (RBI’s) independence following a standoff that has seen top officials quit amid accusations of government interference.

The economy has slowed in each of the past three quarters losing its status as the world's fastest-growing with unemployment hitting its highest level since the 1970s.

The auto sector has been particularly badly hit, with car sales plunging in July for the ninth month running, while weak consumer spending has hit demand for everything from biscuits to hair oil.

The RBI said it had approved a transfer of Rs 1.76 trillion ($24.4 billion) to government coffers, including a dividend of Rs 1.23 trillion and Rs 526bn in excess reserves following the adoption of a new methodology for assessing market risk.

Monday's (26) announcement came days after finance minister Nirmala Sitharaman announced a slew of measures to help the economy, including bringing forward a $10bn liquidity lifeline for credit-shy banks and rolling back an extra levy on equity sales that had spooked foreign investors.

Sujan Hajra, economist at Anand Rathi Securities, said that the latest announcement is a "positive move" for the economy and for public finances.

"As the RBI said, despite this fund transfer India will still have one of the best capitalisations of the central banks globally and it does not reflect poorly on either the government or the central bank," Hajra said.

Ashutosh Datar, an independent economist from Mumbai, agreed, telling: "The amount looks huge but it is not and there is no raid on RBI reserves."

However, the bank's independence has already been called into question after it cut interest rates four times this year to a nine-year low, reportedly under government pressure.

Governor Urjit Patel resigned in December following a public spat with Modi's administration which was re-elected earlier this year accusing it of trying to undermine it.

He was followed in June by deputy governor Viral Acharaya citing the same reasons, although the bank insisted this was unrelated and he had left for personal reasons.

(AFP)

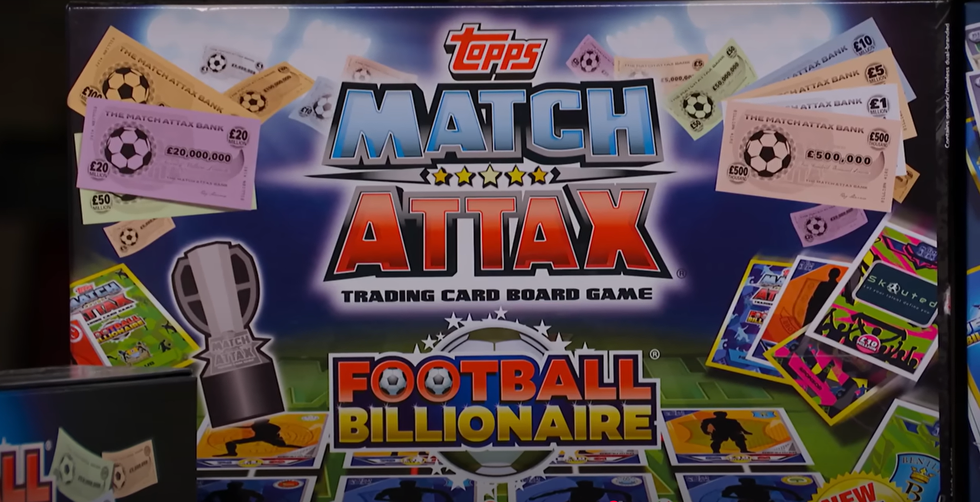

Football-themed board game, Football BillionaireYoutube/ Dragons' Den

Football-themed board game, Football BillionaireYoutube/ Dragons' Den John Caudwell, the billionaire founder of Phones4UInstagram/ johncaudwell

John Caudwell, the billionaire founder of Phones4UInstagram/ johncaudwell