THE Sri Lanka government said on Tuesday (26) it would honour a deal secured by its predecessor to restructure $12.55 billion (£9.97bn) in international sovereign bonds, a key condition to maintain an IMF bailout loan.

The government of president Anura Kumara Dissanayake, which came to power two days after the bond deal was announced in September, said it will implement the restructuring immediately.

A majority of private creditors of the south Asian nation agreed two months ago to a 27 per cent haircut on their loans, but the agreement needed approval of the new administration.

Dissanayake’s National People’s Power (NPP) party had previously criticised the restructuring as being unfavourable to the nation, and vowed to renegotiate after coming to power.

However, since Dissanayake’s party went onto win a landslide in the November 14 parliamentary elections, he has made a U-turn, saying the recovery was too fragile to make any changes.

“The economy is in such a state that it cannot take the slightest shock... there is no room to make mistakes,” Dissanayake said as he ruled out negotiations with either the IMF (International Monetary Fund) or creditors.

“This is not the time to discuss if the terms are good or bad, if the agreement is favourable to us or not... The process had taken about two years and we cannot start all over again,” he said.

“We extend our gratitude to our external creditors, the IMF and the Official Creditor Committee (OCC) for the good faith negotiations that have enabled us to reach this point,” Dissanayake added, also referring to bilateral lenders.

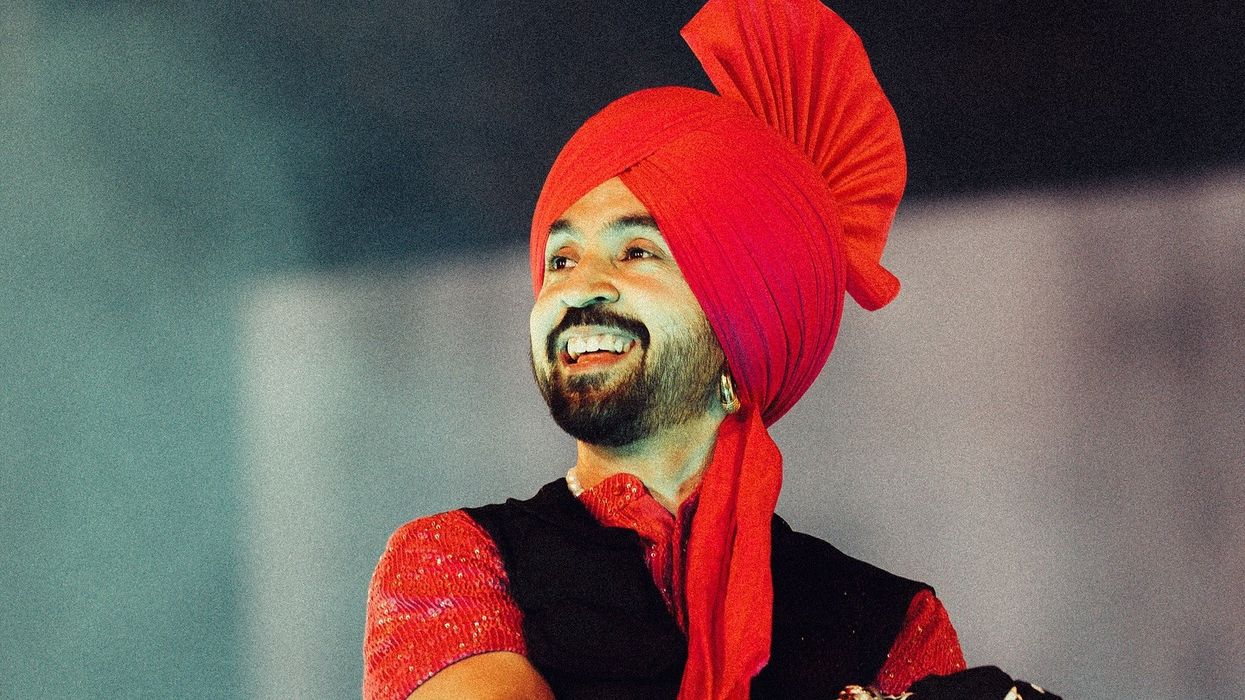

Anura Kumar DissanayakeThe IMF approved the third review of the country’s $2.9bn (£2.3bn) bailout last Saturday (23), but warned the Sri Lankan economy remains vulnerable.

In a statement, the global lender said it would release about $333 million (£265m), bringing total funding to around $1.3bn (£1.03bn), to the crisis-hit nation. It added that signs of an economic recovery were emerging.

Sri Lanka still needs to complete a $12.5bn bondholder debt restructuring and a $10bn (£7.9bn) debt rework with bilateral creditors including Japan, China and India to take the programme forward, the IMF said.

Staying in line with tax revenue requirements and continuing reforms of stateowned enterprises will remain crucial to hitting a primary surplus target of 2.3 per cent of gross domestic product next year, said IMF senior mission chief Peter Breu[1]er, wrapping up a delegation visit to the capital Colombo.

“The authorities have committed to staying within the guardrails of the programme,” Breuer said. “We have agreed on a package for them to achieve their priorities and objectives. As soon as that is submitted to parliament, it will then be possible to go ahead with the fourth review process.”

An interim budget is expected to be presented to parliament in December, Dissanayake said last week. He hopes to complete the debt restructuring by the end of December.

The interim cabinet last month signed off on a controversial restructuring of $14.7bn (£11.67bn) in foreign commercial credit tentatively agreed by Dissanayake’s predecessor Ranil Wickremesinghe. Sri Lanka declared a sovereign default on its external debt in April 2022 after running out of foreign exchange to pay for essential imports such as food, fuel and medicines. The shortages led to months of street protests that forced then president Gotabaya Rajapaksa to step down.

The central bank had expected a debt restructure within a few months, but talks had dragged for more than two years.

International sovereign bonds account for just over $12.5bn of the island’s foreign debt, which stood at $46bn (£36.5bn) during Sri Lanka’s default in 2022. A balance of $2.2bn (£1.7bn) is owed to the China Development Bank.

As part of the deal agreed in September and ratified on Tuesday, bondholders will also take an 11 per cent haircut on overdue interest payments accumulated since the default.

During Sri Lanka’s crisis, a severe dollar shortage sent inflation soaring to 70 per cent, its currency to record lows and its economy contracting by 7.3 per cent during the worst of the fallout and by 2.3 per cent last year. In recent months, the rupee has risen 11.3 per cent and inflation disappeared, with prices falling 0.8 per cent last month.

The island nation’s economy is expected to grow at 4.4 per cent this year, the first increase in three years, according to the World Bank. (Agencies)

From desks to dreams: A journey of girls’ empowerment