UBER and Bolt are contemplating passing the high fuel costs to customers as the ride-hailing firms seek to help their divers.

Uber’s UK arm said last week that it remained focused on offering drivers “the benefits and protections they deserve”.

RAC Foundation data showed that the pump prices of unleaded petrol in the UK shot up from around 126p March last year to 163.59p on Monday (28). The steep rise in the input costs has squeezed the earnings of the drivers, who have to buy their own fuel.

A flat 5p cut in fuel duty announced by chancellor Rishi Sunak last week has brought the prices only marginally.

Both Uber and Bolt are expected to announce their plans to help the drivers later this week. If Bolt increases its price now, it will be a second hike by the company since January when its price went up 10 per cent.

The near record-high fuel costs have been forcing drivers to avoid long-distance drives which would erode their margins further.

“I’m not going to pick up anybody who is farther away because I’m paying for that extra fuel. So there is a knock-on effect for the customer,” Habib Ur-Rehman, a private-hire driver in Manchester, told The Times.

The erosion of their margins means the drivers have to work extra hours to go back home with a decent amount of money in their pockets.

Raja Khan, a driver for courier company Stuart, said his fuel expenses for two days have gone up from £40 last year to £60 now and this compelled him to work for 13 hours a day to make £100.

The Independent Workers’ Union of Great Britain suggested that the drivers are unfairly shouldering the burden of high fuel costs.

“It’s crazy that precarious workers are having to shoulder the cost of this crisis. There needs to be an uplift in their fees that mirrors the uplift in the cost of doing their jobs,” Union president Alex Marshall told the newspaper.

London permission for Uber

In an unrelated development, Uber said it has received permission to operate in London under a new 30-month licence, ending a years-long battle with the city transport regulator over safety concerns.

"Uber has been granted a London private hire vehicle operator's licence for two and a half years," a spokesperson for Transport for London (TfL) said in a statement on Saturday (26).

In 2019, Uber lost its licence to carry paying passengers in London for the second time, and a year later the ride-hailing firm was granted an 18-month London licence after a legal battle to restore its operations. The US company first lost its licence in 2017.

Uber had previously claimed that it has assuaged safety concerns by improving insurance document verification systems and rolling out real-time identification.

The firm also struck a deal with Britain's GMB union last year, allowing it to represent up to 70,000 drivers.

Uber UK said it is making efforts to become a fully electric platform by 2025.

Uber, Bolt may hike prices this week to help drivers

Secretary of state for housing, communities and local government, Steve Reed.

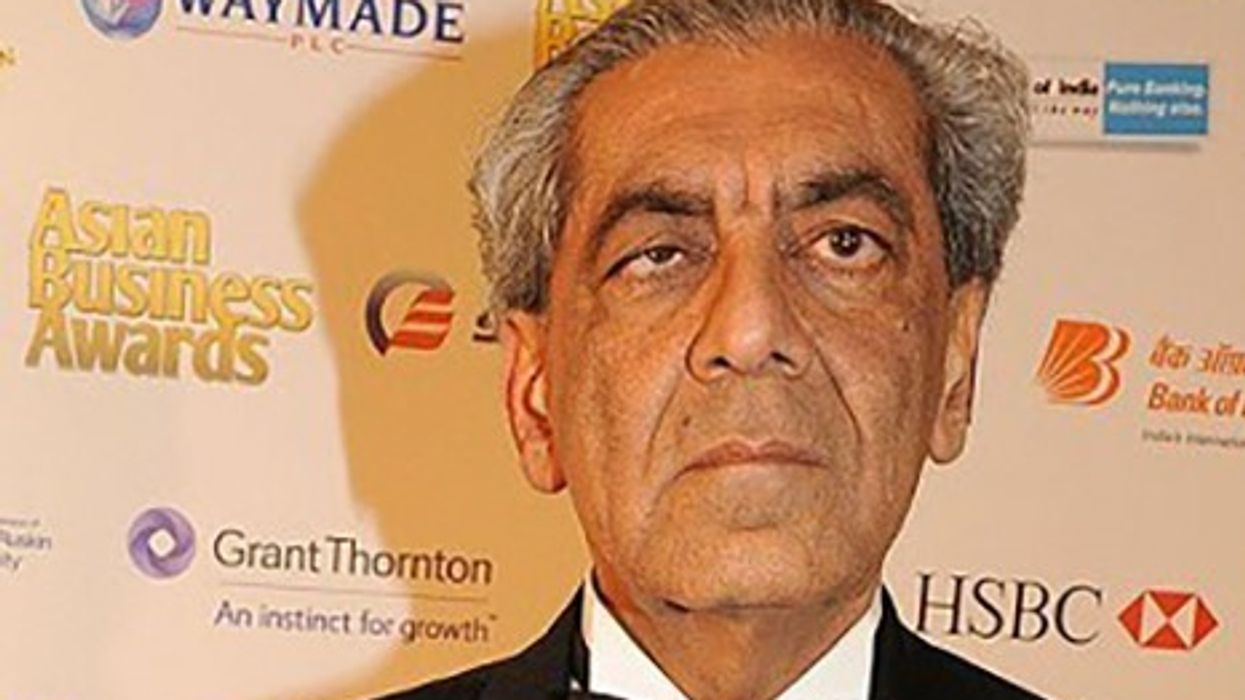

Secretary of state for housing, communities and local government, Steve Reed. Tan Sri Sir Francis Yeoh, executive chairman of the YTL Corporation of Malaysia.

Tan Sri Sir Francis Yeoh, executive chairman of the YTL Corporation of Malaysia.