BRITAIN's annual inflation rate fell to a three-year low in September, official data showed Wednesday (16), fuelling speculation that the Bank of England will resume cutting interest rates next month.

The Consumer Prices Index (CPI) reached 1.7 per cent last month, well below the BoE's two-per cent target, after hitting 2.2 per cent in August, the Office for National Statistics (ONS) said in a statement.

The inflation rate was lower than the 1.9 per cent rise that analysts forecast and has cemented expectations that the central bank would likely cut interest rates again in November.

"Lower airfares and petrol prices were the biggest driver of this month's fall," said Grant Fitzner, chief economist at the ONS.

He added that this was partially offset by a strengthening in food price inflation for the first time since early last year.

The inflation data "clears the path for another 25-basis point rate cut in November", said Richard Flax, chief investment officer at wealth management company Moneyfarm.

"The underlying conditions support this move -– energy prices have eased, the economy has cooled, and the labour market has stabilised," he said.

Chancellor Rachel Reeves (C) chairs a meeting of the National Wealth Fund Taskforce at 11 Downing Street on July 9, 2024 in London, England. (Photo by Justin Tallis - WPA Pool/Getty Images)It comes after official data on Tuesday (15) showed an easing in Britain's unemployment rate and wage growth, which also bolstered analysts expectations of a rate cut.

"It is absolutely amazing to see such a dramatic drop in the UK's CPI number, and the news had brought nothing (but) good things for the Bank of England," said Naeem Aslam, chief investment officer at Zaye Capital Markets.

The inflation news will likely be a boost to the new Labour government ahead of its maiden budget later this month.

Prime minister Keir Starmer has warned Britons that the budget announcement will be "painful", with tax rises and spending cuts expected.

"We are being repeatedly told tough decisions are to be announced, so any sliver of good economic news will likely be pounced upon," said Lindsay James, investment analyst at Quilter Investors.

Starmer's Labour government won power at the start of July, ending 14 years of Tory rule.

In August, the BoE reduced it key rate for the first time since early 2020, from a 16-year high of 5.25 per cent as inflation returned to normal levels.

But it decided against a second reduction in a row in September.

The BoE hiked borrowing costs 14 times between late 2021 -- when they stood at a record-low 0.1 per cent -- and the second half of last year.

Supply-chain disruptions following Covid lockdowns, together with soaring food and energy prices caused by Russia's invasion of Ukraine, sent global inflation surging.

Britain's finance ministry welcomed the fall in inflation, which offers a helpful backdrop for chancellor Rachel Reeves as she readies her first budget, due on Oct. 30.

A less inflationary outlook would slightly improve the economic and fiscal outlook for the budget as Reeves struggles to find the extra money to invest in public services and new infrastructure without spooking investors.

Her spending plans will be watched closely by the BoE.

"Though the stars are aligning for a November rate cut, the upcoming Budget is the final hurdle as rate setters will want to assess the inflationary impact of any measures announced before loosening policy again," Suren Thiru, economics director at ICAEW, an accountancy body, said.

(Agencies)

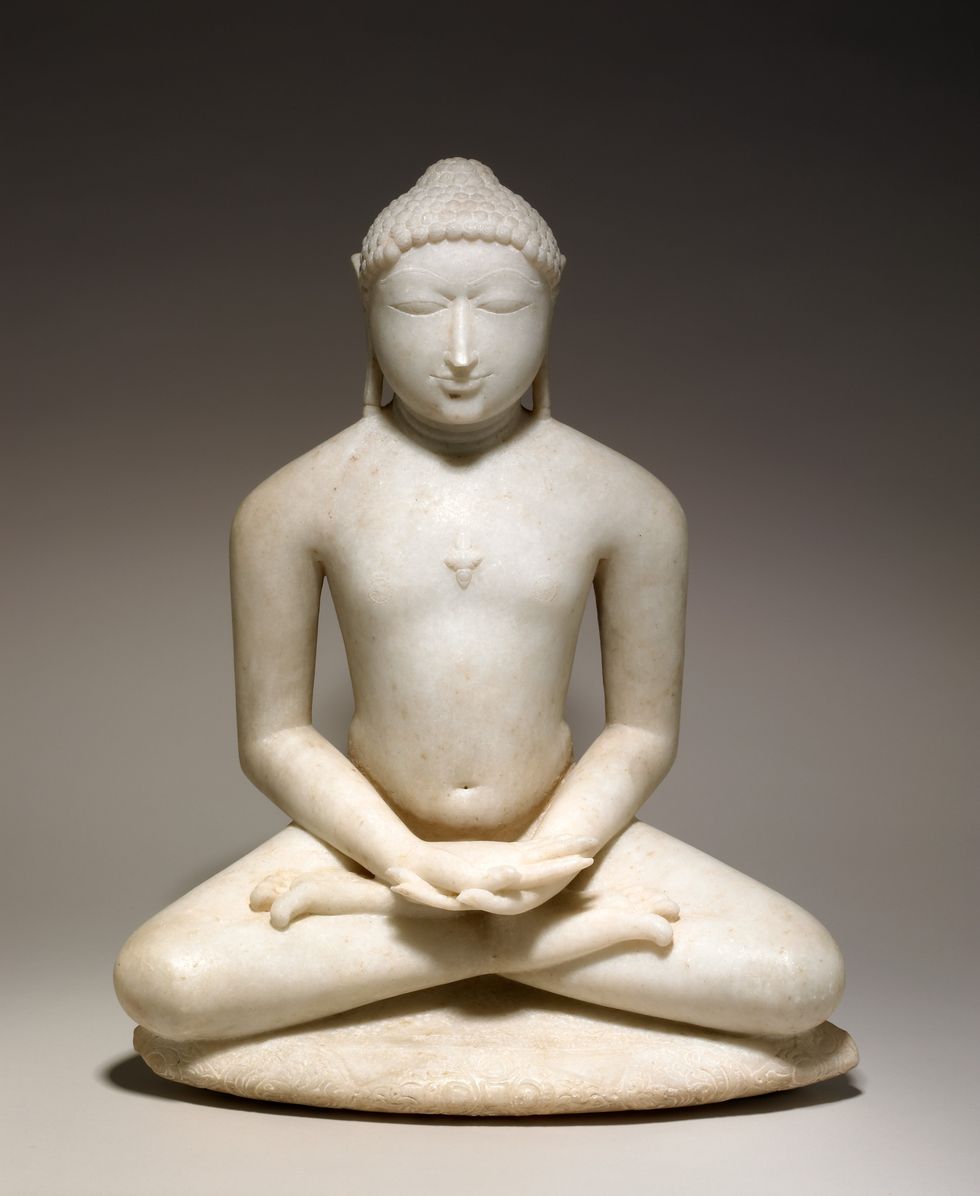

Seated Jain enlightened teacher meditating, about 1150-1200The Trustees of the British Museum

Seated Jain enlightened teacher meditating, about 1150-1200The Trustees of the British Museum Gaja-Lakshmi ('Elephant Lakshmi') goddess of good fortune, about 1780 The Trustees of the British Museum

Gaja-Lakshmi ('Elephant Lakshmi') goddess of good fortune, about 1780 The Trustees of the British Museum Ardhanarishvara, lord who is half woman, Shiva and Parvati combined in one deityThe Trustees of the British Museum

Ardhanarishvara, lord who is half woman, Shiva and Parvati combined in one deityThe Trustees of the British Museum

Mahesh Kale at his concert 'Abhangwari'Instagram/ maheshmkale

Mahesh Kale at his concert 'Abhangwari'Instagram/ maheshmkale

Stunning still from the Songs of the BulbulAngela Grabowska

Stunning still from the Songs of the BulbulAngela Grabowska Stills from Songs of the BulbulAngela Grabowska

Stills from Songs of the BulbulAngela Grabowska